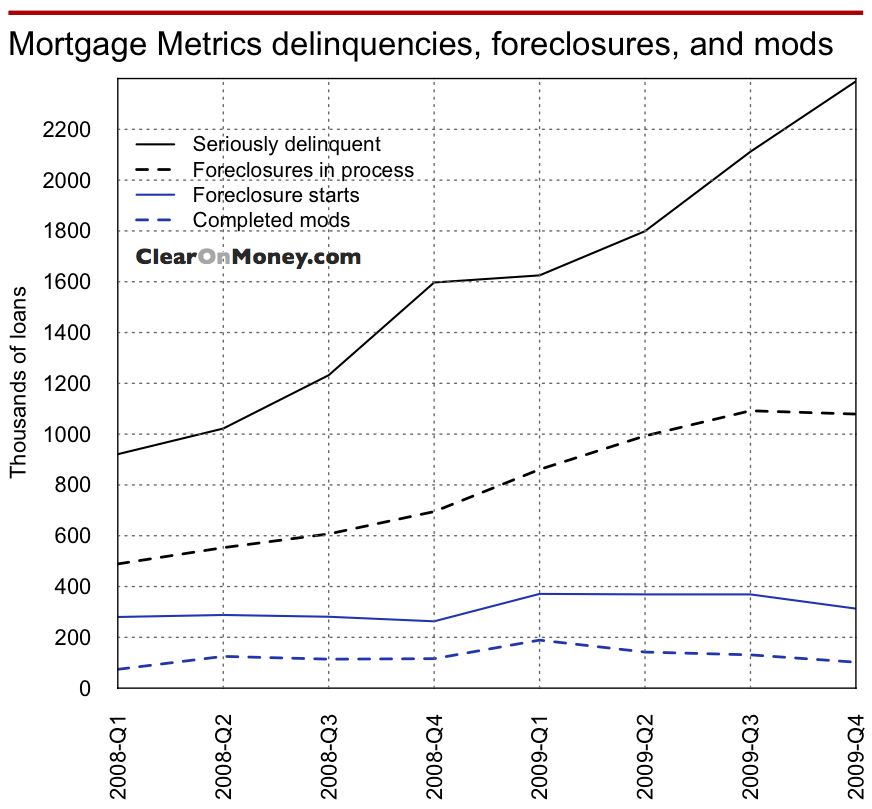

In light of our discussion yesterday (More Foreclosures, Please), Jim Fickett of ClearOnMoney sends us these charts:

They are the result of the Mortgage Metrics report for Q4 of 2009, and the results are distressing.

Serious delinquencies continue to rise – in the 64% of the market covered by Mortgage Metrics, there are now about 3.4 million loans either seriously delinquent or in the process of foreclosures. Completed modifications actually declined in each of Q2-Q4 of 2009. (Foreclosures have been flat).

Thus, as this chart suggests, the various programs amount to little more than window dressing hiding the underlying weakness of the Real Estate market

>

chart courtesy of Clear On Money

More charts after the jump:

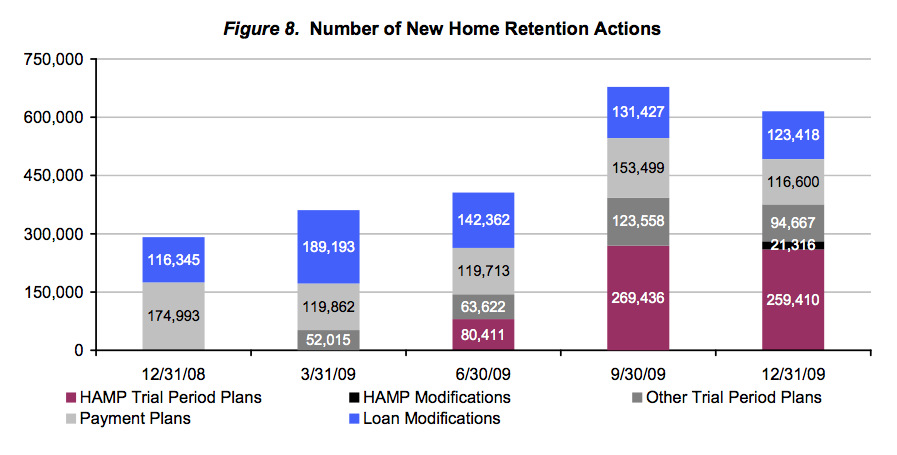

The Treasury is now putting more emphasis on short sales, which approximately doubled from Q4 2008 to Q4 2009 (these numbers are small relative to foreclosures).

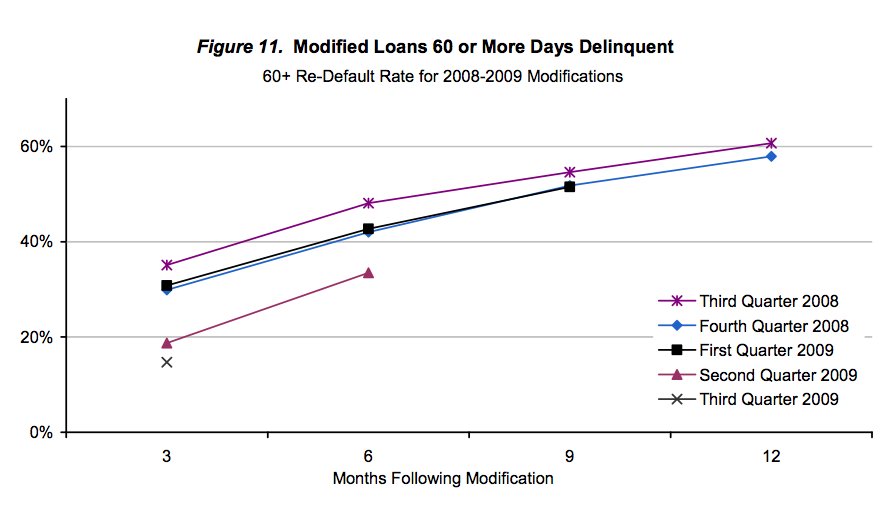

Re-default rates improved marginally, but remain above 50% after 12 months:

The the supply of better qualified candidates are being depleted:

What's been said:

Discussions found on the web: