>

Okay, it’s time for our early spring sermon on sampling and seasonal adjustments perverting PPI and CPI.

For the past month or so, oil and gasoline have rallied, as they tend to do at this time each year. But PPI showed a larger than expected decline for February because of seasonal adjustments on energy.

Still not convinced? Natural gas has collapsed in price over the past few months, yet the BLS is showing an increase in natural gas prices for February due to seasonal adjustments.

PPI declined 0.6% in February, because energy was down 2.9% m/m (+16.6% y/y). Gasoline declined 7.4% but residential natural gas increased 0.8%!

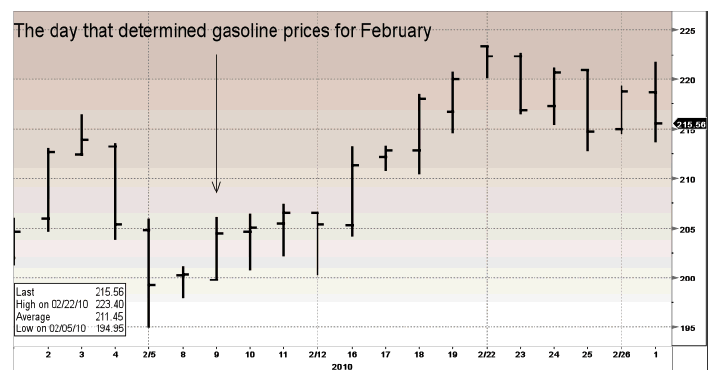

But there’s more nonsense in the PPI. The BLS samples prices on the Tuesday of the week that contains the 13th of the month. So the sampling was done on Tuesday, February 9 – if that’s still the methodology.

Gasoline made a three-month low on Friday, February 5 near 1.95. Two weeks later it was north of 2.20.

On Tuesday, February 9 gasoline futures traded between 2.00 and 2.05. Oh, and don’t forget the at gasoline prices tend to increase on the weekend when more consumers are out shopping.

>

Gasoline futures for April delivery – one day’s price determines the entire month for PPI and CPI.

>

Natural gas futures were the mirror image of gasoline futures. The high for February was Monday, February 8 at 5.60ish. The next day it traded below 5.40 and collapsed below 4.70 by month’s end.

So PPI and CPI, and even elements of NFP, data comes from a sample on one day. This is exactly like saying the price of IBM in February was its price at some point on Tuesday, February 9. But it is a means to keep inflation and inflationary expectations ‘subdued’. This is lazy, erroneous data gathering because private industry knows what the monthly cost of a unit of gasoline or natural gas to the penny. It’s nothing more that revenue divided by unit sold.

Here’s the problem, the seasonal adjustments for energy will turn negative by summer, so energy prices will be adjusted higher, when they might be declining in the real world.

US Senators, led by democrats Charlie Schumer and Debbi Stabenow and Republicans Sam Brownback and Lindsey Graham introduced legislation to make it easier for the US to declare China a currency manipulator.

For decades US politicians and hackneyed economists have brayed that a lower dollar is the panacea to US economic problems because it will stimulate exports. If currency debasement were the key to export supremacy, Mexico, Latam and Italy would be China, Japan and South Korea.

The dollar has lost 75% of its value versus the yen (~360 to 90) since 1970. How’s that working out?

People, including the duly elected of the US, keep averring that the yuan is undervalued. But the flip side, and this might be more accurate, is that the dollar is overvalued.

Traders tried to affect a Weird Wednesday [of expiry week] rally but there are so few ‘legitimate’ orders on the Street that the usual triple-digit DJIA rally for expiry didn’t materialize.

Instead we got what has been the standard 30 to 50-points DJIA rally. And of course,

What's been said:

Discussions found on the web: