There’s been plenty of speculation about what will happen to mortgage rates if and when the Federal Reserve wraps up the last of its planned purchases under the $1.25 trillion Mortgage-Backed Security (MBS) purchase program, first announced in November 2008.

While there have been some suggestions that the Fed may extend and expand the program beyond the end of next month, nothing has been said officially. Assuming it ends on March 31st as planned, the laws of supply-and-demand would seem to indicate that the MBS market is headed for a heap of trouble. Why? The Fed has been the biggest buyer of residential mortgage-backed securities by far over the past year or so.

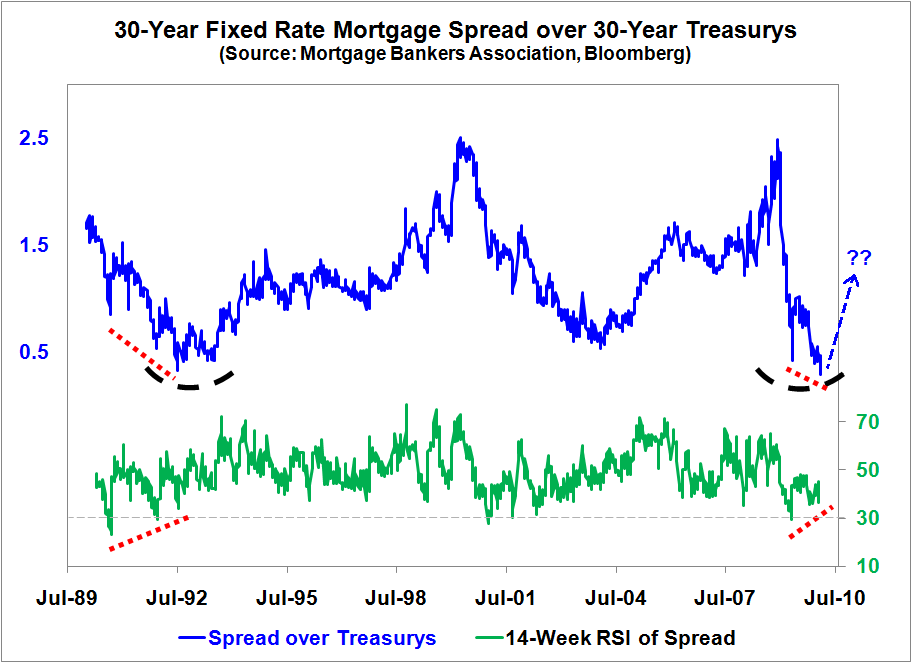

That means yields and/or spreads on mortgage-related borrowings have only one way to go. As it happens, a quick read of the chart of the 30-year fixed-rate mortgage yield less its government bond market counterpart lends further weight to that view. That is, it looks rather bullish — which is bad for borrowers.

In fact, based on what happened following the similar technical pattern that developed in the early 1990s, we may well be on the cusp of a secular rise in the cost of mortgage-related financing costs. Another reason, perhaps, to bet against a near-term recovery in house prices.

What's been said:

Discussions found on the web: