The NYT digs up a secret Lehman Brothers memo about Hudson Castle — part of a financial system that enabled banks to exchange investments for cash to finance their operations — and mislead investors to make their finances appear stronger than they actually were.

NYT:

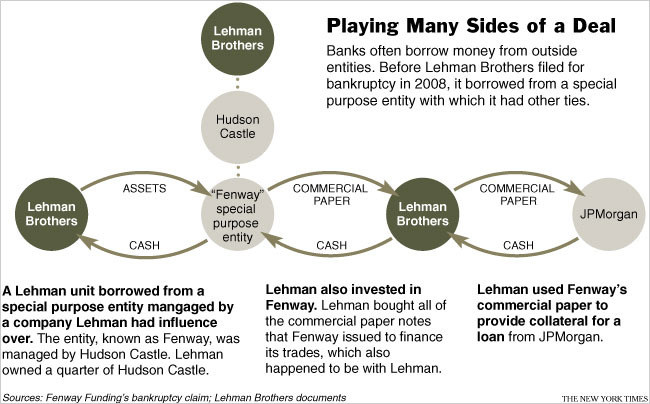

Critics say that such deals helped Lehman and other banks temporarily transfer their exposure to the risky investments tied to subprime mortgages and commercial real estate. Even now, a year and a half after Lehman’s collapse, major banks still undertake such transactions with businesses whose names, like Hudson Castle’s, are rarely mentioned outside of footnotes in financial statements, if at all.

The graphic below is a simplified explanatory of how the risk hiding worked:

>

chart courtesy of NYT

>

Source:

Lehman Channeled Risks Through ‘Alter Ego’ Firm

LOUISE STORY and ERIC DASH

NYT, April 12, 2010

http://www.nytimes.com/2010/04/13/business/13lehman.html

What's been said:

Discussions found on the web: