The NYT is reporting that A.I.G. has dismissed Goldman Sachs as an advisor:

The NYT is reporting that A.I.G. has dismissed Goldman Sachs as an advisor:

“A.I.G., the insurance giant that planned to retain Goldman to help reorganize its businesses, has replaced Goldman as its main corporate adviser, according to three people with knowledge of the matter, which was not intended to be public. Instead, the insurer is turning to Citigroup and Bank of America.

The move is the first in what some analysts warn could be a series of defections among Goldman’s clients after accusations — vigorously denied by Goldman — that it defrauded customers in a complex mortgage investment.”

I don’t buy into the Goldman defections — yet — due to the fraud allegations.

This smells like a little payback for Goldman’s role in the AIG collapse.

Don’t get me wrong, Goldie didn’t kill AIG, the insurer committed suicide. They were were reckless in their embrace of derivatives and had horrific risk management. As noted in Bailout Nation, the head of AIG FP, Tom Savage, actually said “The models suggested that the risk was so remote that the fees were almost free money. Just put it on your books and enjoy.”

So I don’t want anyone to think I am blaming Goldie for AIG’s demise.

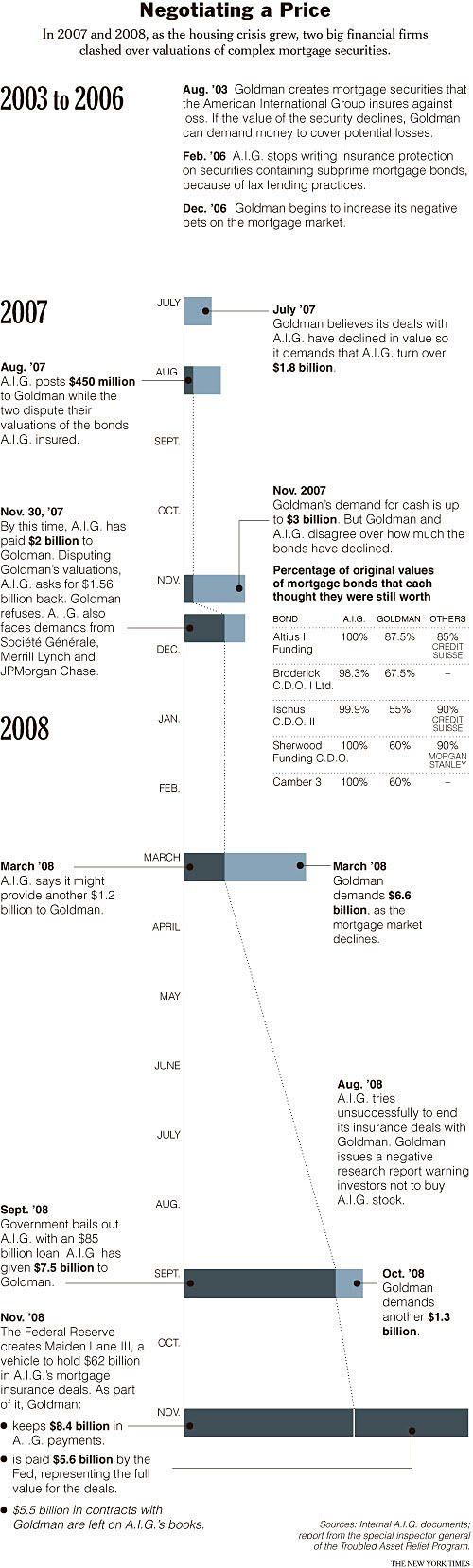

But they were the first vulture to arrive at the site of the wounded body, and they began tearing at AIG’s flesh before it was even carrion. Almost $20 billion in transfers took place from AIG to GS — BEFORE their collapse, BEFORE the bailouts. The rest of the taxpayer gift — at 100 cents on the dollar — was simply free money.

So, if you were in AIG’s shoes, and you had an opportunity to kick Goldie when they are stumbling around a bit — why wouldn’t you give them a swift knee to the groin?

Payback is a bitch . . .

>

Source:

A.I.G. Said to Dismiss Goldman

LOUISE STORY and ERIC DASH

NYT, May 6, 2010

http://www.nytimes.com/2010/05/07/business/07goldman.html

What's been said:

Discussions found on the web: