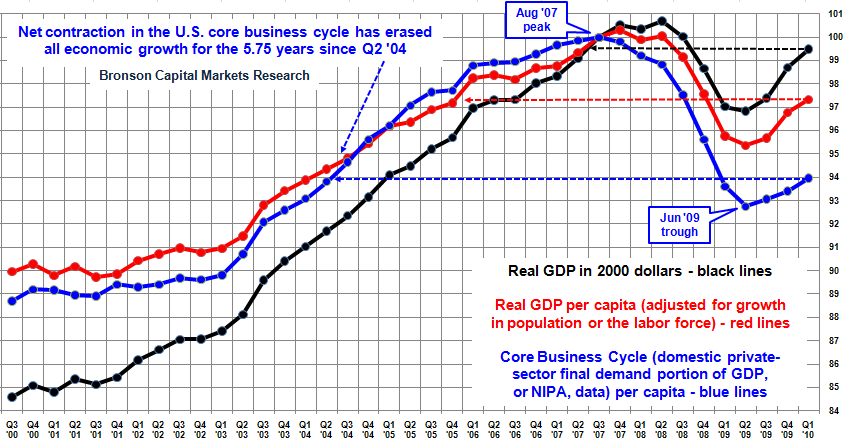

Bob Bronson is in the bearish camp. He argues that the “Permabulls are at it again — promoting the notion that a deep or sharp V-shaped recovery is well underway, using just reported Q1 GDP data for support.”

I don’t necessarily agree, but Bronson’s work is always interesting.

Bob’s beef is that the headline figure of 3.2% annualized growth was down 40+% from the Q4 growth rate of 5.6%. Hence, we see a sharp deceleration in the so-called economic recovery. Hardly what one would expect to see in a healthy robust post recession expansion.

And though Q1 was the third consecutive quarter of positive growth following three quarters of negative growth, this does not automatically mean we will have a balanced, V-shaped recovery, nor does it preclude a double dip recession.

Rather than focus on GDP, investors should pay attention to what Bob terms “the core business cycle” — below:

>

click for larger graphic

courtesy of Bronson Capital Markets Research

>

The second chart below illustrates the Q1 GDP update of our working model of the double double-dips we expect, followed by a range of possible similar shapes of what can be more broadly thought of as a very wide U-shaped trough, or \____/ , rather than even the upside-down square root sign that only a few economists are expecting, as compared to the deep and/or sharp V-shaped and eventually self-sustaining recovery that the current consensus of them expects.

>

click for larger graphic

courtesy of Bronson Capital Markets Research

What's been said:

Discussions found on the web: