While there can be no doubt that adding jobs is a better outcome than losing them, there remain some trouble spots that bear watching as we move forward.

David Rosenberg hit on some of them in his research note on Friday, and I’ve taken the liberty of replicating some of his charts (click for larger versions), along with adding a couple of my own.

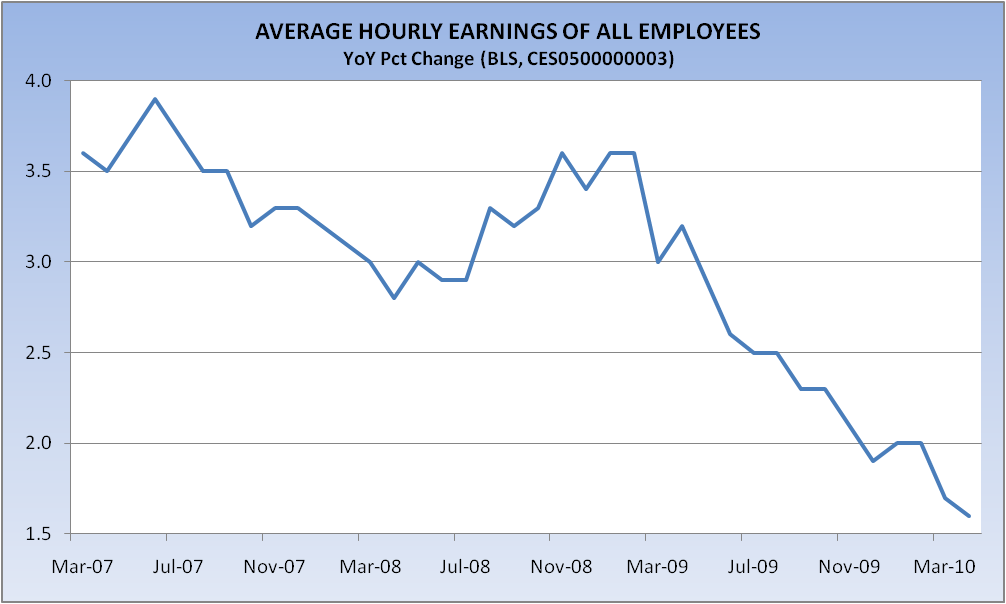

We have almost fallen into wage deflation:

Wrote Rosie:

Consider this to be uncharted territory. In fact, at $22.47, average hourly pay has not budged at all since the turn of the year — in other words, the wage rate has already begun to stagnate.

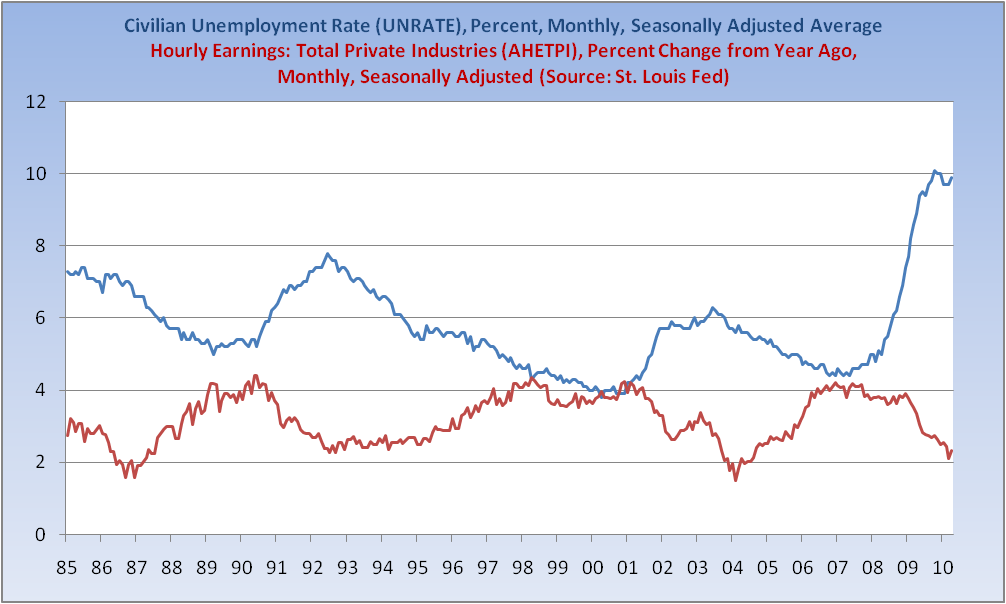

Among my favorite charts (homemade, of course) designed to reflect the amount of slack in the labor market is this one, which shows the Unemployment Rate (percent) along with the Year-over-Year percent change in Average Hourly Earnings. Note the symmetry. (NOTE: The Average Hourly Earnings used below is not the same series as used above, hence the difference in levels, though the trend is clearly the same.)

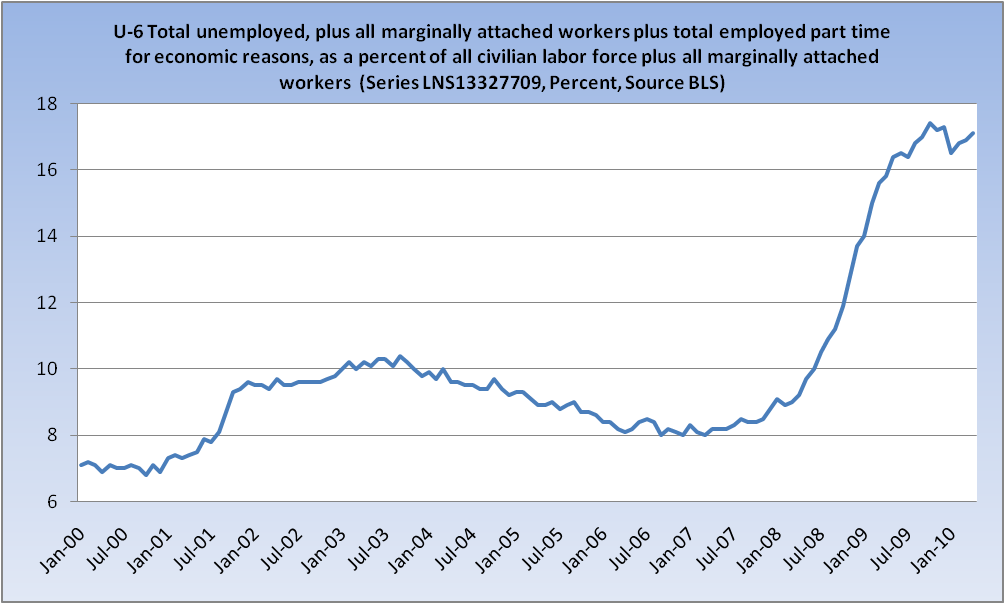

We also found out on Friday that the broadest measure of unemployment — U6 — has ticked back up to 17.1%:

This is the stuff that deflation is made of.

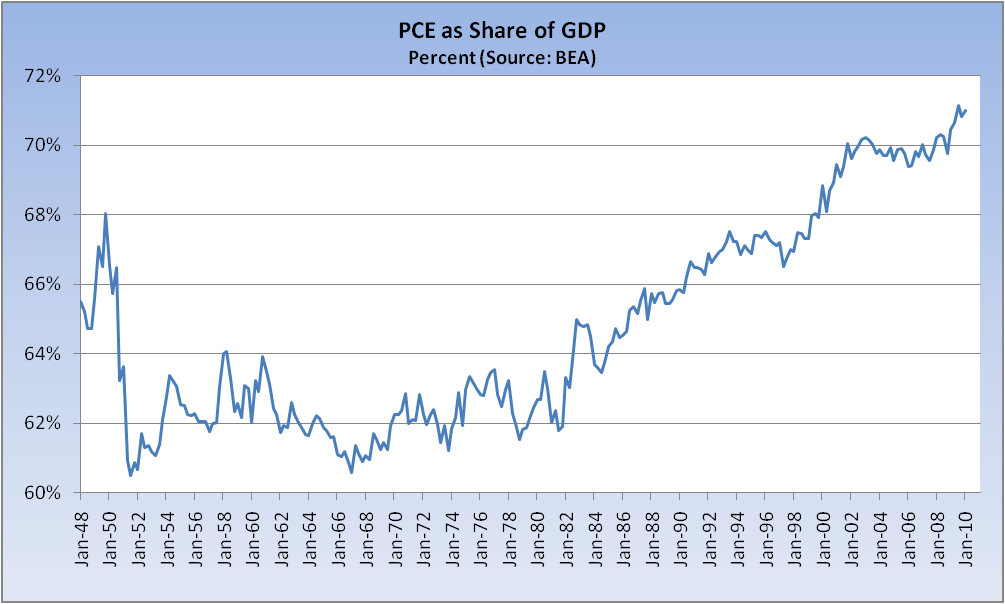

Yet somehow Personal Consumption Expenditures have managed to rise to a new record as a percent of GDP:

One has to wonder, I’d think, how much longer this is sustainable.

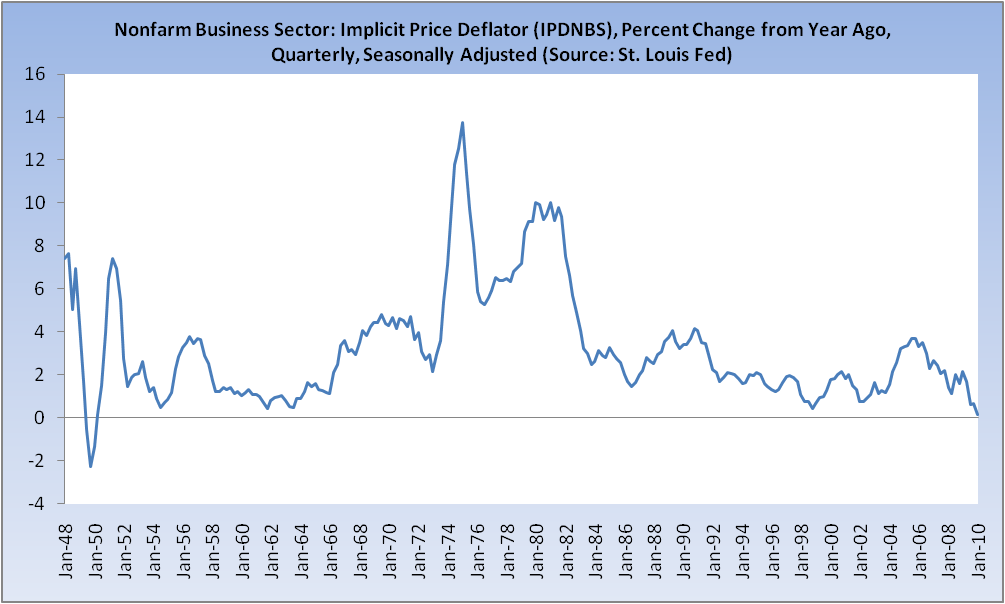

Further, it’s clear that businesses have limited (if any) pricing power:

Rosenberg:

Moreover, the price deflator for the corporate sector was a mere +0.6% at annual rate in Q1 and +0.1% on a YoY basis. In other words, the corporate sector, notwithstanding the profits rebound, which has been centered more in financials than in industrials, is 10 basis points shy of outright deflation.

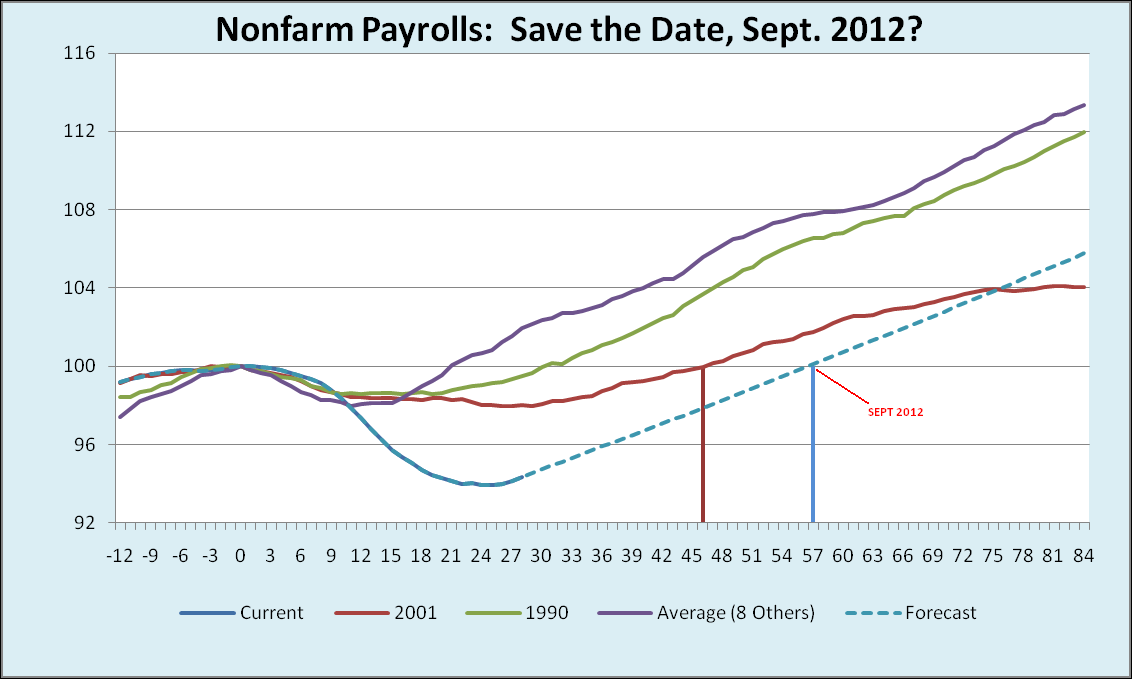

Lastly, I venture a guess as to when we will recoup all the jobs lost in the Great Recession — that is to say that we get back to Square One. If — operative word right there — from here we can produce jobs at roughly the average run rate coming out of the past eight recessions — specifically excluding 2001 and 1990 — we’d be on target for Sept. 2012, a record long jobs recovery. If we create jobs at the 1990 or 2001 post-recession pace, which seems the more likely scenario, you can tack another 18-24 months on to that.

What's been said:

Discussions found on the web: