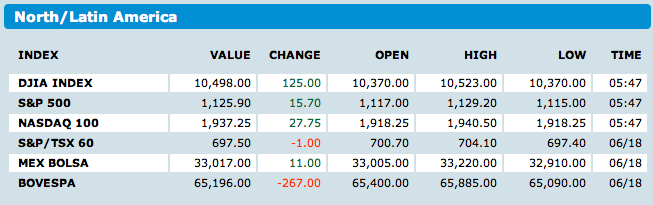

Global equity futures are up strongly on the weekend announcement by the People’s Bank of China regarding the depeg of the Yuan to the dollar (US Futures below).

To be blunt, the Chinese announcement is only that — an announcement which may or may not be followed through. As such, we should treat it as a precursor, and not the significant shift the market seems to be making of the announcement.

I am neither a currency nor a China expert; however, a few items have emerged:

• Protectionist legislation is being discussed in the US due to the über cheap Chinese exports; this announcement may preempt Congress from passing it.

• In theory, a rising Yuan can help reduce Sino-inflation, which has been running way above global trend;

• China might be concerned that global economies, especially in Europe and America, remain soft, and this could be of aid to the exporters in those countries.

Whenever the PBOC makes a grand announcement, I am reminded of the Ralph Waldo Emerson comment: “What you do speaks so loudly that I cannot hear what you say.”

Rather than make grand changes to your asset allocation mix, we would suggest waiting until their is evidence of action, rather than react to mere announcements . . .

>

What's been said:

Discussions found on the web: