>

Surprise! Analysts remain too Bullish:

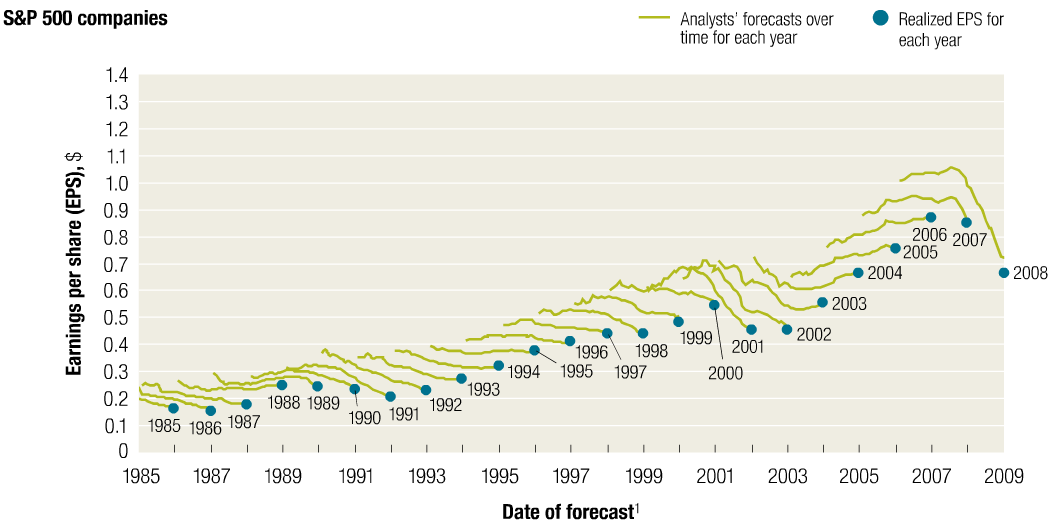

“Exceptions to the long pattern of excessively optimistic forecasts are rare, as a progression of consensus earnings estimates for the S&P 500 shows (Exhibit 1). Only in years such as 2003 to 2006, when strong economic growth generated actual earnings that caught up with earlier predictions, do forecasts actually hit the mark.

This pattern confirms our earlier findings that analysts typically lag behind events in revising their forecasts to reflect new economic conditions. When economic growth accelerates, the size of the forecast error declines; when economic growth slows, it increases. So as economic growth cycles up and down, the actual earnings S&P 500 companies report occasionally coincide with the analysts’ forecasts, as they did, for example, in 1988, from 1994 to 1997, and from 2003 to 2006.

Moreover, analysts have been persistently overoptimistic for the past 25 years, with estimates ranging from 10 to 12 percent a year, compared with actual earnings growth of 6 percent. Over this time frame, actual earnings growth surpassed forecasts in only two instances, both during the earnings recovery following a recession. On average, analysts’ forecasts have been almost 100 percent too high.” (emphasis added)

The good news is the markets don’t take analysts nearly as seriously as they used to . . .

Note: I rarely quote McKinsey, as I have a pet theory they are at the root of all economic evil in the world. So far, my evidence is only anecdotal. If anyone wants a summer internship quantifying the negative impact of McKinsey on the world via actual data, please contact me.

>

Source:

Equity analysts: Still too bullish

Marc Goedhart, Rishi Raj, and Abhishek Saxena

McKinsey Corporate Finance Practice, APRIL 2010

https://www.mckinseyquarterly.com/Equity_analysts_Still_too_bullish_2565

What's been said:

Discussions found on the web: