Kudos to BR for a nice tout in this week’s Up and Down Wall Street column in Barron’s, penned this week by Randall Forsyth:

A graphic from the U.K. Guardian passed along by Barry Ritholtz on his terrific blog, The Big Picture (www.ritholtz. com/blog), shows that the U.S. consumes 25% of global oil output while having less than 5% of the world’s population. This helps explain the Brits’ feeling that we Yanks are being less than honest with ourselves in our pique at BP. “They raise a valid point,” he adds.

Beyond that, Mr. Forsyth jumps right into a recent discussion had right here at TBP, to wit: The future of the bond market:

THERE’S MORE TO LIKE ABOUT Treasuries other than the lack of alternatives. Even though their yields are down substantially from early April—when the benchmark 10-year note was 4% and the conventional wisdom said it had nowhere to go but up—don’t be surprised if it drops back below 3%.

Hmmm…sounds like a familiar theme.

Of most interest in the column, however, was this (emphasis added):

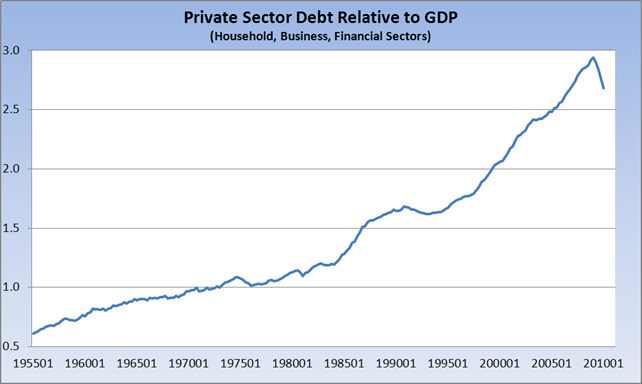

The real problem is that the economy remains mired in a debt-deflationary cycle from which the only way out is through paying down the debt. Nomura chief U.S. economist David Resler says that, even after households paid down debt for the seventh straight quarter in the first quarter, the process still has a long way to go. That, even with a $374 billion reduction in household borrowing from its peak of $13.9 trillion in the second quarter of 2008, with most of the drop coming in mortgage debt.

In fact, financial deleveraging has just begun, according to BCA Daily Insights, a publication of the Bank Credit Analyst. That points to renewed underperformance by financial stocks, which has started during the market’s current corrective phase, it adds. […]

“The end of the implosion in credit quality has also helped support profits, but there has been a massive amount of wealth destruction. This implies that credit creation will remain weak and it will be difficult for the financial sector to re-expand.

“As long as credit growth remains flaccid, hiring stays weak and inflation non-existent, there’s no logical reason for the Fed to start tightening. And with short-term rates (and inflation) hovering near zero, a sub-3% 10-year Treasury and a long bond under 4% hardly seem unreasonable.

Now, if there’s meaningful data point out there to be mined, you can pretty much rest assured that David Rosenberg has mined it. And, in fact, his current presentation includes a slide, which I’ve replicated below, that shows the extent of the problem described by Mr. Forsyth via David Resler and BCA Daily Insights:

(Source: Federal Reserve Flow of Funds, BEA.gov)

Dave titles this slide “The U.S. Will Spend Years Deleveraging This Chart,” and it’s certainly hard to quibble with that. If anyone has a reasonable argument to make that the downtrend in the chart above is going to reverse itself any time soon, I’m all ears.

What's been said:

Discussions found on the web: