The Chicago Fed’s National Activity Index (CFNAI) printed this morning at 8:30 AM Eastern. As always, Calculated Risk covered the release, so I won’t rehash what’s covered over there.

However, I will note — as I have before — that the Personal Consumption & Housing subcomponent remains mired in deeply negative territory. In fact, it has not made a positive contribution to the overall index since December 2006, running negative now for 42 consecutive months.

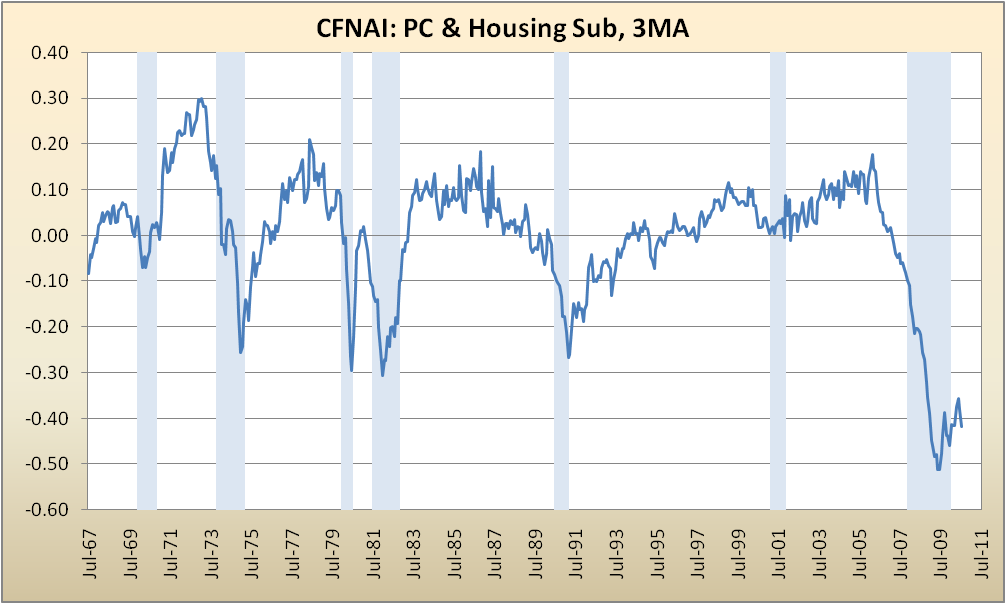

To filter out the noise (as the Chicago Fed suggests), below is the 3-month moving average of the PC & H subcomponent:

Sales, Orders and Inventories (which together comprise one category) was the only positive contributor to the overall index, and even that metric only eked out a +0.05 add.

So the growth bulls continue to shoulder the burden of explaining specifically how we can muster a sustainable economic recovery — which is to say at or at least near trend — without the participation of the consumer and the housing market.

What's been said:

Discussions found on the web: