OK, last post on this subject:

Bruce Bartlett wrote me to fill in the full Reagan tax story (recall he was a domestic policy adviser to Reagan and was in the Treasury under President George H.W. Bush). He notes that RR began with tax cuts during the recession, but took about half of them back before his term ended. (I’ll ask him about deficit spending for another post).

Bartlett writes that:

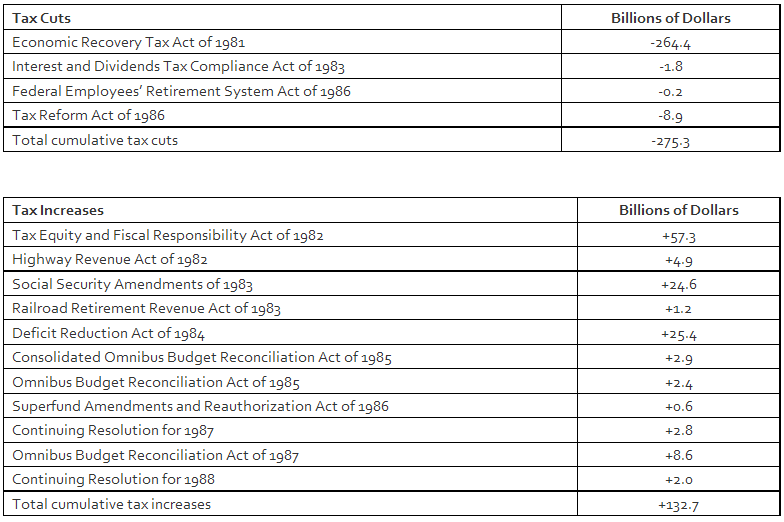

“Reagan signed into law the Tax Equity and Fiscal Responsibility Act in 1982 before the recession was even over and went on to sign 10 more major tax increases during his administration. By 1988 he had taken back half the 1981 tax cut. These tax increases were most enacted as part of budget deals that cut domestic discretionary spending. Compared to today’s Republicans, Reagan was a model of fiscal responsibility.”

He pointed me to this chart from his blog:

>

Legislated Tax Changes by Ronald Reagan as of 1988

Source: Office of Management and Budget, Budget of the United States Government, Fiscal Year 1990 (Washington: U.S. Government Printing Office, 1989), p. 4-4.

What's been said:

Discussions found on the web: