I am winging my way home from Canada, flying over Minnesota into Wisconsin. I am catching up with some reading, but I had to comment on all the Sturm und Drang about the expiration of the Bush Tax “cuts.”

A few thoughts:

• Temporary Stimulus: These tax cuts were passed as temporary tax cuts to stimulate an economy coming out of a recession. (At least, that was the sales pitch). As I have noted in these pages, that is appropriate government recession policy: Stimulate now, reduce deficit later. Of course, if these were really geared towards that purpose, they should have expired after 3 years or so.

• Inherent Gimmick: When a sunset provision is used to obscure how much tax cuts actually cost, you have a marketing gimmick Now, because of that precise gimmick, they are about to go away. Lesson to future administrations: If you really want permanent tax cuts, well, then you should pass, um, permanent tax cuts. And if you cannot sell an expensive tax cut to the public, perhaps that might be telling you something…

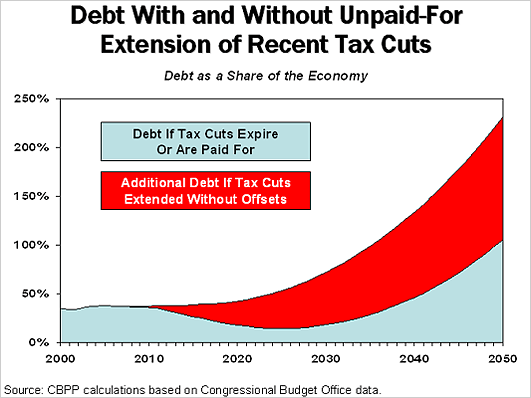

• Unfunded Tax Cuts: You will note that the I have the word “Cuts” in quotes. Why? To quote Milton Friedman, “When is a tax cut not a tax cut? When the so-called tax cut is accompanied by a larger rise in government spending than in prices.” In other words, all unfunded tax cuts — including these — are actually future tax increases on the next generation.

• Offsetting Spending: Of course, if the tax argument wasn’t a debate between cowards on one side and liars on the other, we would actually be discussing, as per Friedman, what spending to cut: Entitlements, Military, Education, etc. Don’t hold your breath waiting for that healthy debate to take place.

~~~

Any thoughts on this subject ? (Note that I have only discussed facts, not my opinion about whether this should stay or go . . . )

>

UPDATE: July 26, 2010 9:33pm

Since 43 of you have sent me the same chart . . .

What's been said:

Discussions found on the web: