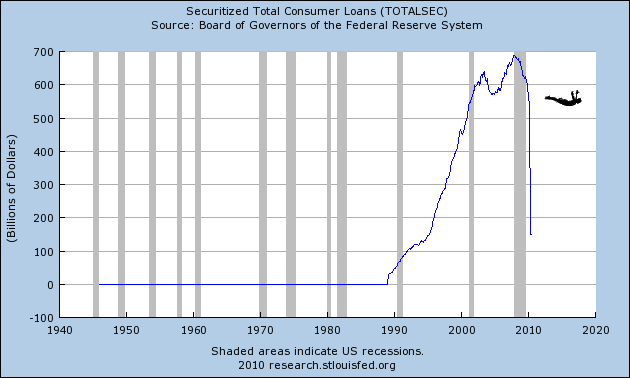

I honestly have no idea what this means, but jeez, how is this for some cliff diving:

>

Chart via St. Louis Fed

>

This is what the BOG reports on the G.19. The footnotes on g.19 state the following:

-Outstanding balances of pools upon which securities have been issued; these balances are no longer carried on the balance sheets of the loan originators.

-The shift of consumer credit from pools of securitized assets to other categories is largely due to financial institutions’ implementation of the FAS 166/167 accounting rules.

What's been said:

Discussions found on the web: