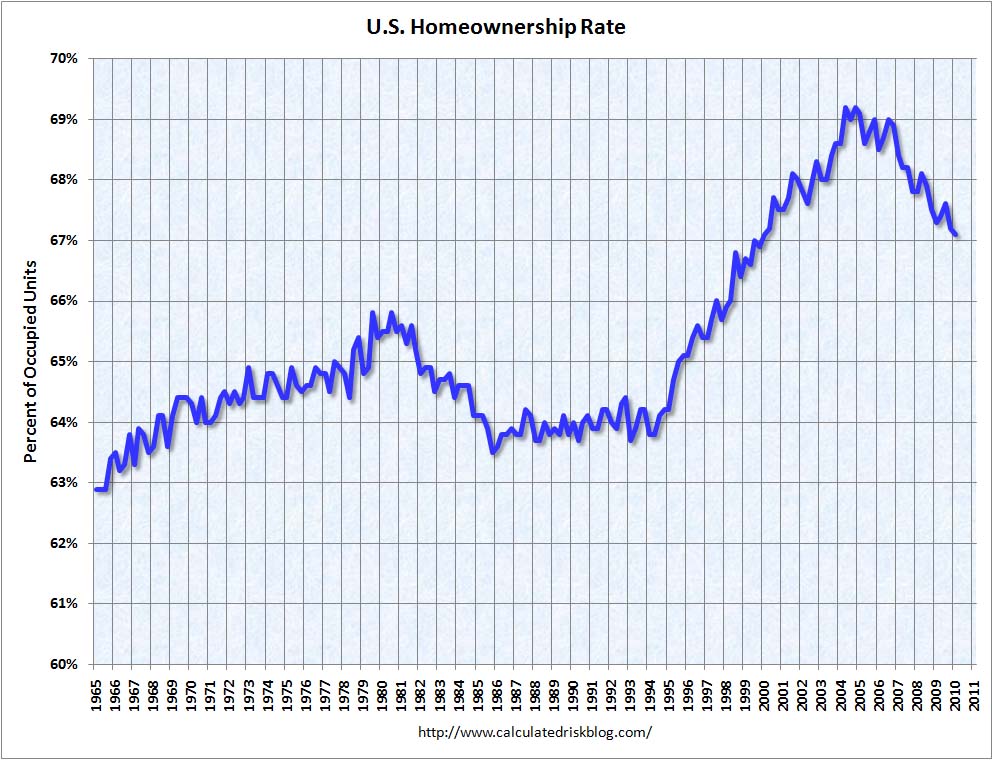

The ongoing deleveraging of the American Consumer continues apace. The most recent evidence of this is the 2.0% decrease in homeownership rates. My expectations as we work through the next 5 million foreclosures is that rate will revert towards historical means, before settling in near the 65% area. (John Burns forecasts 62%).

However, the NY Fed produced a report, however, that suggests a very different number. Back out “Home-Owers,” (Neg Equity Households) they say, and you already are at a 62% ownership rate:

“Recent years have seen a sharp rise in the number of negative equity homeowners — those who owe more on their mortgages than their houses are worth. These homeowners are included in the official homeownership rate computed by the Census Bureau, but the savings they must amass to retain their home or purchase a new home are daunting. Recognizing that these homeowners are likely to convert to renters over time, the authors of this analysis calculate an “effective” rate of homeownership that excludes negative equity households. They argue that the effective rate — 5.6% points below the official rate — may be a useful guide to the future path of the official rate.”

Expect to see more discussions on this interesting data point . . .

>

US Homeownership Rate (1965-2010)

\chart via Calculated Risk

>

Sources:

The Homeownership Gap

Authors: Andrew Haughwout, Richard Peach, and Joseph Tracy

May 2010 Volume 16, Number 5

JEL classification: G21, R31, R51

http://www.newyorkfed.org/research/current_issues/ci16-5.html

What's been said:

Discussions found on the web: