The following was written by Lakshman Achuthan and Anirvan Banerji, co-founders of ECRI:

~~~

“As Geoffrey H. Moore once reminded us, if you can ‘predict’ a recession just as it’s beginning you are doing very well as a forecaster.” We recalled our mentor’s observation in our book, Beating the Business Cycle, and it’s just as relevant today as it ever was.

With the economy slowing, the double-dip recession debate has naturally assumed center stage. Perhaps you already know something about the Economic Cycle Research Institute (ECRI) or the Weekly Leading Index from your favorite analyst, commentator or blog. But, as debates go, this one is becoming heated and ECRI is being misrepresented more often than not. We write this note in an effort to address the more extreme misperceptions.

Recent diatribes from investment managers with blogs have culminated in an accusation that we are dishonest when it comes to ECRI’s forecast track record in the lead-up to the 2007-09 recession. Having ECRI’s forecast challenged is nothing new, but we’ve never had our professional integrity called into question, until now. Criticism of our work comes with the territory, but such charges do not. Therefore we ask you to consider what’s been left out of that narrative and, more importantly, why. Inquiring minds would surely investigate before accepting such character assassination.

One would find that the facts are willfully misrepresented, perhaps in an attempt to undermine ECRI’s credibility when expedient. Our detractor’s declaration is based on a cherry-picked quote from a PowerPoint file (including discussion notes) that we posted on our website on October 5, 2009. Ten months later, on Aug. 4, 2010, the charge was that “ECRI is caught” in an “Outright Lie,” saying that we claim to have forecast the recession in November 2007. This is simply made up.

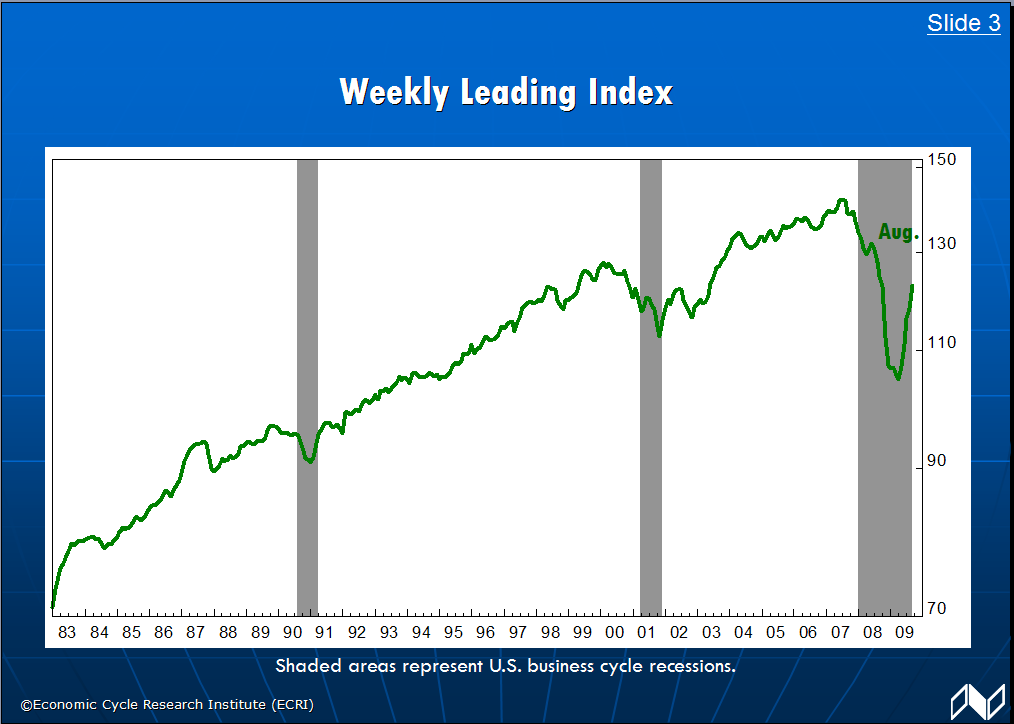

Evidence offered to support this allegation resides on the third slide of 23 from an October 2009 ECRI presentation titled The Great Recession and Recovery. That slide shows our Weekly Leading Index (WLI) and includes an ECRI discussion note for the presentation saying that the WLI has been around for over a quarter century and that “it has correctly predicted every recession and recovery in real-time.”

In fact, that statement is undeniably true. The WLI peaked and went into a cyclical downturn six months before the recession began. So this is hardly a smoking gun.

In evaluating the performance of any leading indicator, the key question is whether its cyclical turn occurred before the cyclical turn in the economy. If so, the follow-on question is whether that lead occurred in real time, or showed up only in revised data. In the case in question the WLI peak occurred well before the business cycle peak, in real time. That was the point of that slide.

But, nowhere on the slide in question does ECRI claim to have predicted the recession. Nowhere do we equate ECRI to the WLI. To the contrary, a few slides later, we say that ECRI called the recession in March 2008. It’s inconceivable that anyone attending the actual presentation, or reviewing the presentation in retrospect, could come away believing otherwise.

To be clear, our detractors are capable of understanding what we’ve been saying all along. On July 20, 2010 they wrote:

“I suppose you can see how confusing this is when the WLI ‘has correctly predicted every recession and recovery in real time’ yet Lakshman Achuthan also says … ‘In fact, at the very least, ECRI itself would need to see a ‘pronounced, pervasive and persistent’ decline in the level of the WLI (not merely negative readings in its growth rate) following a ‘pronounced, pervasive and persistent’ decline in ECRI’s U.S. Long Leading Index (not discussed in the article), before it makes a recession call.’ That is a clear statement that the WLI cannot in and of itself predict anything unless it follows the ECRI’s U.S. Long Leading Index.”

That focus on our “clear statement” is correct. In fact, ECRI interprets the WLI in the context of our full array of leading indexes (including the Long Leading Index) as outlined in chapter seven of Beating the Business Cycle (Doubleday, 2004). And yet, these critics try to malign ECRI by conflating the WLI’s movements with ECRI’s recession calls.

The Whole Truth

Just go to The Great Recession and Recovery, which provides a clear timeline of ECRI’s forecasts from the fall of 2007 through summer 2009. We encourage you to examine the full presentation firsthand, but here are the pertinent slides from that presentation, starting with the third slide:

click for larger charts

1. Weekly Leading Index

2. Recession Warning

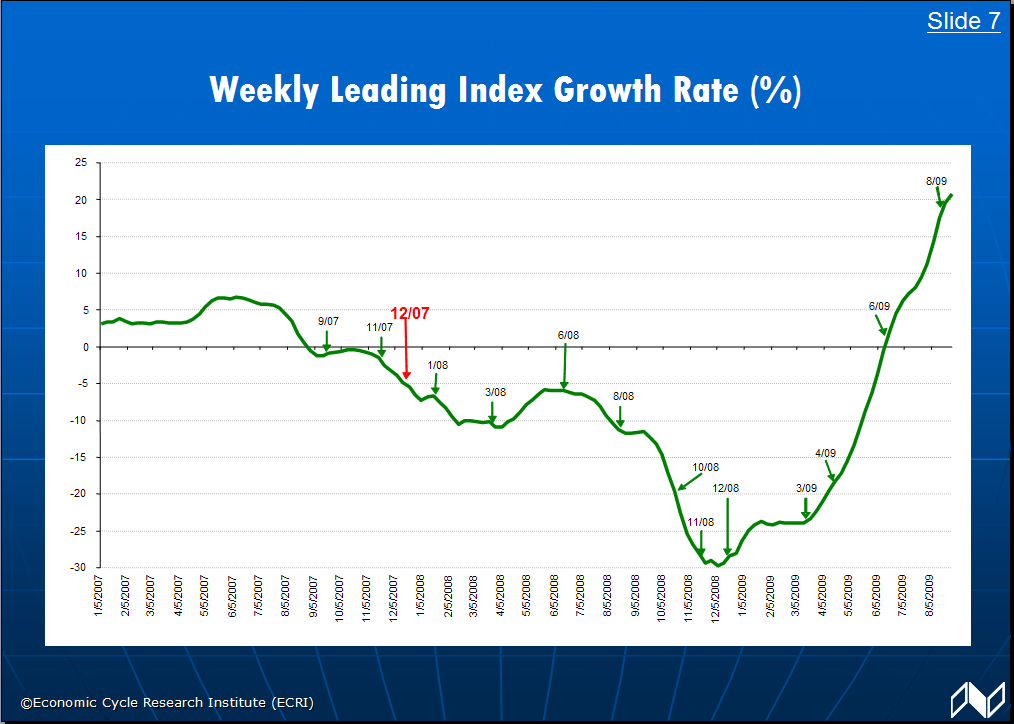

3. Weekly Leading Index Growth Rate (%)

4. On the Cusp of Recession

5. A Self-Reinforcing Downturn

6. “A Recession of Choice”

After reading these slides would you really be left with the impression that ECRI claims to have called the recession before March 2008? We don’t think so. Yet if you only saw carefully selected “snips,” while critical parts were withheld, you might understandably begin to doubt ECRI’s honesty.

An aside: why did ECRI hold off on calling recession until March 2008? That’s a whole other story, but we believed at the time, as we believe today, that the recession didn’t have to begin or evolve the way that it did.

Stepping back, it’s important to note that this presentation was hardly the only place where we discussed our recession call in retrospect. Take a look, for instance, at our Oct. 2, 2009 article, prominently displayed for months on our website, which explicitly identifies March 2008 as our official recession call date. There’s no doubt about when we say we made our recession call.

Furthermore, that same article emphatically disproves another line of criticism from naysayers: that ECRI is so scared to make recession calls that by the time we make them they’re useless. To summarize our article, even if you were to be as simplistic as to sell stocks when ECRI says recession and buy stocks when we say recovery, those would be very valuable calls. Here’s what would have happened over the past cycle:

A Measure of Value

If you sold the S&P 500 the day we made our “late” recession call in March 2008, you’d have sidestepped 72% of the cyclical bear market decline (from the October 2007 high to the March 2009 low). Then, if you had bought stocks on the very day in April 2009 we made a recovery call, you’d still have enjoyed 64% of the cyclical bull market in stocks (from the March 2009 low to the April 2010 high) – not bad considering that the first 25% of that rally occurred within two weeks of the market bottom.

If instead you’d had a buy-and-hold strategy for stocks, then at the April 2010 market peak, you’d still be down 16% compared with the October 2007 market peak. But if you’d sold stocks the day we said recession and bought stocks the day we said recovery, you’d be up 39% since October 2007, beating the S&P by 55 percentage points.

Finally, on February 5, 2010, we discussed a chart of the Long Leading Index on CNBC, highlighting the risk of a new downturn in stock prices, which began just two months later. Just how much more does a free service have to do in order to be deemed useful?

Now, please understand that ECRI will never be perfect, and, in any case, we aren’t in the business of making market calls. So, why would some people go to such lengths in an attempt to undercut our credibility? We don’t know, but in this case a search of the fund manager’s blog shows that promotion or criticism of our work seems to depend on whether we reinforce or challenge his views.

Cycles of Credibility?

For example, on Oct. 18, 2008, the WLI and ECRI are held up as supporting evidence for a pessimistic view of the economy with headlines like “Leading Indicators at 33 Year Low,” going on to quote us directly: “With its biggest weekly plunge in 37 years WLI growth has dived to a new 33-year low. This data objectively shows that financial market turmoil is rapidly worsening an already-grim recessionary outlook.”

But a year later, after ECRI forecast a recovery, our views are no longer validating the pessimistic consensus and are therefore suspect – as seen on Oct. 8, 2009, with headlines like, “Can We Really Trust The Leading Economic Indicators?” There followed a list of statements we had recently made about the upturn such as: “With WLI growth continuing to surge through late summer, a double dip back into recession in the fourth quarter is simply out of the question.” (Aug. ’09)

The investment manager went on to share his newfound skepticism: “…what I suspect but cannot prove, is the LEI or WLI (Weekly Leading Index) criteria applied to data in 1930 would have shown something that did not happen: a big recovery was coming.” Then by May 28, 2010 there is a switch back to once again promoting the WLI: “ECRI Leading Indicators Dip Again; Is a Double-Dip Recession Coming?”

If you look at the history, there’s a clear lack of consistency in these arguments. But this is just one example of attacks on ECRI. Far more important is a broad misunderstanding of what ECRI is all about. Where does that come from?

Confirmation Bias

A big part of the “problem” may lie with ECRI’s impressive track record.

Those with a bullish or bearish agenda may be threatened when ECRI or the WLI makes – or seems to make – a call that challenges their views. As we saw a few months ago, when the WLI moves in a way that reinforces the views of one camp and contradicts the views of the other, the former group (in this case, the bearish camp) extols its accuracy while the other (in this case, the bullish camp) tries to explain it away or find flaws with the WLI itself.

Last fall it was this need to challenge ECRI, given its track record, that drove Paul Krugman to applaud an investment manager’s “awesome takedown” of ECRI. Overcoming ideological differences, they were patting each other on the back for impugning our track record.<

Because the respective agendas of these otherwise strange bedfellows required the U.S. recession to persist, ECRI’s economic recovery call stood in their way. At the time, we defended ourselves in detail, and requested Mr. Krugman to acknowledge the correctness of our call if, a year later (i.e., two months from now), ECRI was proven right. Despite four straight quarters of positive GDP growth and seven consecutive months of positive private sector job growth thus far, we’d be surprised if he ever admits the accuracy of our forecast.

In defense of his views, and in an apparent attempt to undercut the credibility of ECRI’s forecast, Mr. Krugman wrote at the time that “this is a really, really bad time to be relying on conventional indicators… historical correlations, to the extent that they exist… can’t be counted on to prevail.” Please make note of this critique, because there are many variations on this theme, rooted in a fundamental misunderstanding of ECRI’s indexes and methods shared by the overwhelming majority of observers.

There are a number of valid ways to describe ECRI’s leading indexes, but “conventional” is not one of them. In fact, the implicit suggestion that the WLI cannot be relied upon because “historical correlations… can’t be counted on” is revealing, and completely off-base – because the construction of ECRI’s leading indexes isn’t rooted in historical correlations or regressions, or in the back-fitting of data. This seems incomprehensible to most conventional economists – monetarists, Keynesians, and everybody in between – because the pseudo-science of econometrics is the only analytical approach they’ve ever been taught. Very few of our critics (or admirers, for that matter) appreciate the fact that we don’t use models because they are singularly unsuited to business cycle analysis – even though we’ve said this six ways to Sunday.

Thus, some critics question our work based on their belief that “historical correlations” wouldn’t prevail in this cycle, unaware that this wouldn’t affect the performance of our indexes, since they aren’t fitted to back data anyway. And detractors, implying that our indexes must have been fitted to the postwar period, suspect that the “WLI criteria applied to data in 1930 would have shown something that did not happen: a big recovery was coming” – unaware that, while the WLI goes back only to 1949, other ECRI leading indexes, including the U.S. Long Leading Index, work very well in the 1930s and earlier decades in predicting recessions and recoveries – without any attempt at data fitting.

When we make such statements, they are typically ignored or met with a wall of disbelief. Indeed, conventional economists – which is to say, virtually all economists – have so thoroughly embraced the “scientific” model-based approach to economic analysis that it’s hard for them to imagine that any other approach could possibly exist.

Physics Envy

At this point we are reminded of Friedrich von Hayek’s trenchant critique of economists’ analytical methods during his 1974 Nobel lecture: “It seems to me that this failure of the economists to guide policy more successfully is closely connected with their propensity to imitate as closely as possible the procedures of the brilliantly successful physical sciences – an attempt which in our field may lead to outright error. It is an approach which has come to be described as the ‘scientistic’ attitude – an attitude which, as I defined it some thirty years ago, ‘is decidedly unscientific in the true sense of the word, since it involves a mechanical and uncritical application of habits of thought to fields different from those in which they have been formed.’”

This “physics envy,” as we explain in Beating the Business Cycle, is the nub of the matter. While model-based approaches to analysis are often appropriate in the hard sciences, they aren’t always suited to economics, and are singularly inappropriate for the analysis and prediction of business cycles, which are rooted in a highly complex non-linear system, with myriad feedback loops, lags, threshold effects and diffusion processes, that are virtually impossible to specify properly in the context of a constantly evolving global economy. A model optimized to fit a specific past time period will not only be sub-optimal for the future, but also result in highly inaccurate forecasts if economic conditions are very different from those for which the model is optimized. Moreover, if linearized models are used, as is often the case, in place of more appropriate but statistically intractable non-linear models, the model specification errors may result in wildly inaccurate forecasts.

Because our research group is keenly aware of these issues, we have always eschewed a model-oriented optimization-based approach to business cycle forecasting. ECRI’s focus has always been on robustness, i.e., making sure our leading indexes’ turning points consistently anticipate the economy’s turning points, even in the face of major structural changes. This has been the secret of ECRI’s long-term success, and the reason why our leading indexes once again turned down months before the Great Recession in 2007, and turned up before the recovery in 2009 when the overwhelming consensus was dead against an economic recovery forecast.

But our approach is also inconsistent with recently popular notions – once again based on conventional back-fitting of data – that, somehow, when the WLI growth rate hits a specific negative number, a recession always follows. Firstly, it’s the WLI itself, not its growth rate (i.e., its speed of descent), that’s designed to predict economic recession and recovery. Secondly, historical data going back six decades shows that the nice round number of minus 10% doesn’t work too well anyway as a recession signal. But, most importantly – regardless of unfounded accusations that we’ve “abandoned” our own indexes just because we distance ourselves from these simplistic data-mining exercises – the whole idea is fundamentally flawed. In other words, it’s a bit naïve to believe that some variety of data fitting based on conventional statistics using the WLI will tell you how to predict recession and recovery – especially if, as our critics never tire of asserting, it’s different this time.

To add to the confusion, there’s a belief in certain quarters that some of the most prominent analysts who’ve highlighted the WLI also have access to ECRI’s Long Leading Index (LLI), which looks further ahead. Let’s be clear: they don’t. And some who’ve tried to guess the LLI’s moves based on what they know of other leading indexes have also been way off base.

Separately, few analysts crunching the WLI data realize they shouldn’t be using the WLI in regression models – to make GDP forecasts, for instance. To cite a classic textbook[2] on forecasting, leading indexes – including the WLI – are “intended only to forecast the timing of turning points and not the size of the forthcoming downswing or upswing, nor to be a general indicator of the economy at times other than near turning points.” It therefore warns against using “standard statistical techniques” to draw inferences from leading indexes.

While such techniques require certain assumptions, ECRI’s approach – unlike econometric models – makes virtually no assumptions that could be invalidated. This is a great advantage in “unusually uncertain” times. Yet, by sidestepping models, we also constrain what we can predict. Keenly aware of the limitations of our tools, we focus on turning point forecasts – not magnitude forecasts – whether about GDP growth or the jobless rate. This is also why we avoid advocating or decrying any specific policy measure, except rarely, in the narrow context of policy timing.

A key danger of being wedded to any particular ideology or market view is confirmation bias – the tendency to selectively focus on evidence supporting what one already believes or wants to be true. The resultant lack of objectivity is an enemy of forecast accuracy. That’s why we don’t belong to any particular “camp,” accusations notwithstanding. When our objective leading indexes change cyclical direction, we change our view about the economy’s direction, period. As a result, we find ourselves being alternately feted and reviled by liberals and conservatives, bulls and bears, while we stick to our knitting.

As Good as It Gets

Predicting the economy’s turning points is really hard, and we know that we’ll inevitably make mistakes. That’s why – instead of developing back-fitted models – the entire thrust of ECRI’s research over the decades has been to stress-test our leading indexes under a variety of structural conditions in dozens of economies, understand the conditions under which the approach would break down, and design a durable system of indicators that’ll keep working even under unusual circumstances.

Sure, there are many questions about the economy our tools don’t help us address. For instance, based on our leading indexes we couldn’t tell you what the economy will be doing in the second half of 2011. Dr. Moore taught us that we shouldn’t try to “predict the predictors,” and we’ve learned over the years that he was right. In such a complex economy, we simply aren’t smart enough to know which way they’ll head. What we can do is to closely monitor our array of leading indexes, knowing that they’ve rarely led us astray.

ECRI isn’t in competition to be the first to proclaim recession or recovery. But we strive to make our objective turning point calls both highly reliable and timely enough to be useful to decision makers.

We also spend a good deal of time thinking about the broad backdrop against which these shorter-term cyclical fluctuations occur, and in early 2009 these thoughts brought us to the inescapable conclusion that this decade will see more frequent recessions than most of us remember. These frequent recessions will result from the convergence of higher cyclical volatility and lower trend growth during expansions.

Keeping this in mind, please understand that ECRI’s approach to leading indicator analysis is designed to ensure that our leading indexes are robust enough to function accurately even in unusual economic environments, like we have today. Regardless of ad hominem personal attacks, coupled with confusion about how to interpret ECRI’s leading indexes, ECRI’s disciplined and objective approach to economic cycle forecasting is the most reliable method we know about, for signaling recessions and recoveries.

On Jan. 25, 2008 we publicly described the opportunity to forestall the recession, “A Window of Opportunity” and then on Mar. 28, 2008, we described how that opportunity had been missed in “A Recession of Choice”.

“Forecasting Economic Time Series” by C. W. J. Granger and P. Newbold (Second Edition, 1986), New York: Academic Press.

What's been said:

Discussions found on the web: