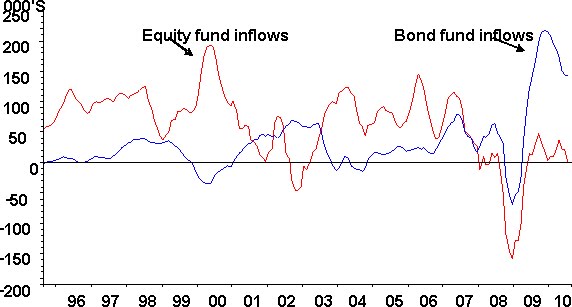

Much ink has been spilt over the question of whether government bonds are in a bubble or not. The bond bubble believers love to cite stats along the lines that bonds are witnessing inflows at the same pace as equity funds did during the TMT bubble.

The bond lovers respond an asset with a finite life and no hope of limitless capital gain can’t really be a ‘bubble’, and beside they argue the ‘fundamentals’ warrant current valuations. (i.e. inflation is low and will remain so).

However, to me this is largely a sterile debate over semantics. The issue shouldn’t be whether bond are a bubble or not, but rather are bonds a good investment or not? Ben Graham defined “An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative”.

Do bonds offers long term investors a sensible level of return? I’ve always thought that in essence bond valuation is a rather simple process (at least one level). I generally view bonds as having three components: the real yield, expected inflation and an inflation risk premium.

The real yield can be measured in the market thanks to inflation-linked bonds. In the US, a 10 year Tip is trading at just under 1%. Expected inflation can be assessed in a variety of ways. We could use surveys, for instance, the Survey of Professional forecasters shows an expected inflation rate of just under 2.5% p.a. over the next decade. In contrast, the nominal bonds minus the TIP yields implies a figure of more like 1.5% p.a. The inflation swap market is implying a 2% p.a. inflation rate over the next ten years.

The inflation risk premium (a risk premium to compensate for the uncertainty of future inflation) is generally held to be between 25bps and 50bps. Given the uncertainties surrounding the impact of monetary and fiscal policy I’d argue that using the high end of that range seems reasonable.

Using these inputs a ‘fair value’ under normal inflation would be around 4%. Of course, this assumes that the current market 1% real yield is itself a ‘fair price’. This seems like a questionable assumption to me. In the UK we have a longer history of index linked bonds – introduced in 1986. The average yield since the introduction is 2.6%, in the last decade the average real yield has been 1.5%. Given this ‘parameter’ uncertainty is would be reasonable to say that ‘fair value’ for 10 year bonds is somewhere in the range of 4-5%.

The current 2.5% yield on the US 10 year bond is clearly a long way short of this. So unless you believe that Japan is correct template for the US (i.e. inflation will be zero for the next decade), government bonds don’t offer an attractive return as a buy and hold proposition.

Another way of looking at this problem is to ask how much weight the market is putting on a ‘Japanese’ outcome. Let’s assume three states of the world (a gross simplification, but convenient). In the ‘Normal’ state of the world bonds sit at close to equilibrium, say 4.5%. Under a ‘Japanese’ outcome yields drop to 1%, and under an inflation outcome yield rise to 7.5% (this assumes a 5% inflation rate).

The table below lays out my own estimates (kind of an agnostic view, with a prior biased towards the ‘Normal’ but cognizant of the other two risks), then bond should yield around 4.4%. I can then tinker around with the probabilities to generate something close to the market’s current pricing. In essence, the market is implying a 70% probability that the US turns Japanese.

| Bond Yield | JM Probabilities | Market implied | |

| Normal | 4.5 | 0.5 | 0.2 |

| Japan | 1 | 0.25 | 0.7 |

| Inflation | 7.5 | 0.25 | 0.1 |

| Expected Yield | 4.4 | 2.4 |

It is possible to build a speculative case for bond investment (i.e. riding the deflationary news flow down), however, as ever this leaves participants with the conundrum of Cinderella’s ball as described by Warren Buffett “The giddy participants all plan to leave just seconds before midnight. There is a problem though: They are dancing in a room in which the clocks have no hands!” Personally I prefer to stick to investment rather than speculation.

What's been said:

Discussions found on the web: