Case Shiller:

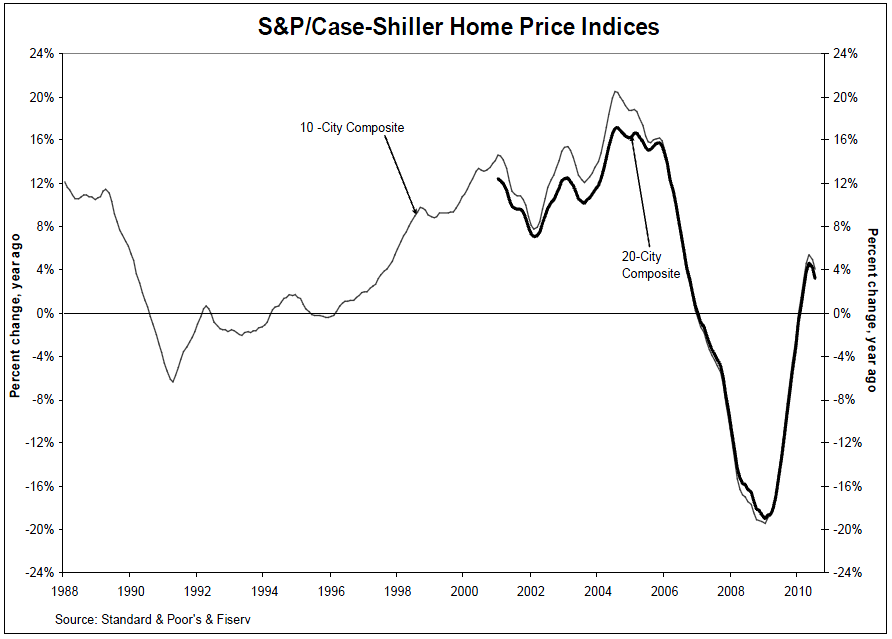

“Home prices crept forward in July. Ten of the 20 cities saw year-over-year gains and only one – Las Vegas – made a new bottom, as the impact of the first time home buyer program continued to fade away. The year-overyear growth rates for 16 of the cities and both Composites weakened in July compared to June.

While we could still see some residual support from the homebuyers’ tax credit, which covers purchases closing

through September 30th, anyone looking for home price to return to the lofty 2005-2006 might be disappointed. Judging from the recent behavior of the housing market, stable prices seem more likely.Annual growth rates in 16 of the 20 MSAs and the 10- and 20-City Composites slowed in July compared to June 2010. The 10-City Composite is up 4.1% and the 20-City Composite is up 3.2% from where they were in July 2009. For June they were reported as +5.0% and +4.2%, respectively. Although home prices increased in most markets in July versus June, 15 MSAs and both Composites saw these monthly rates moderate in July.

>

More charts after the jump

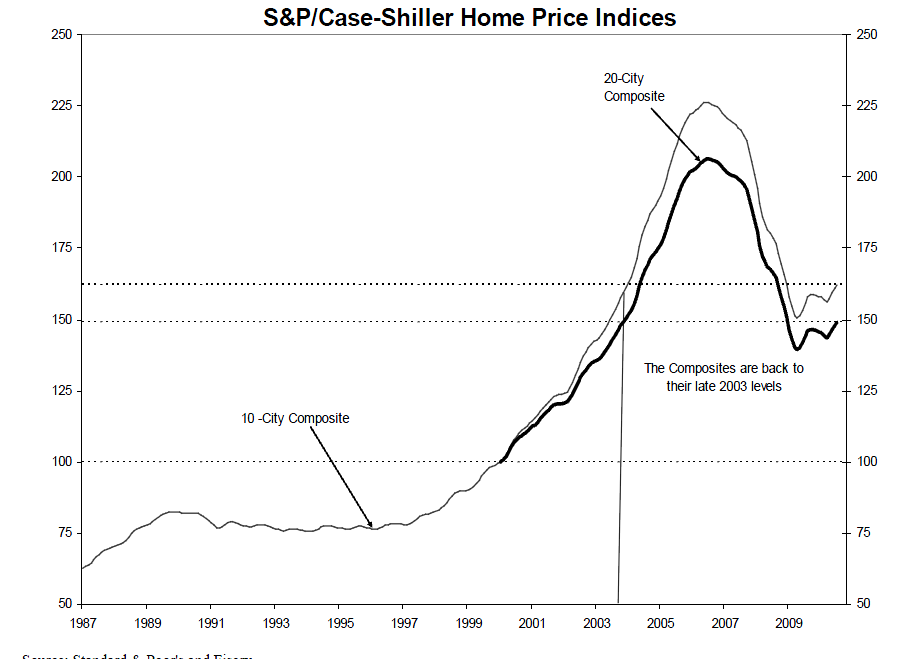

We are now back to 2003 price levels:

>

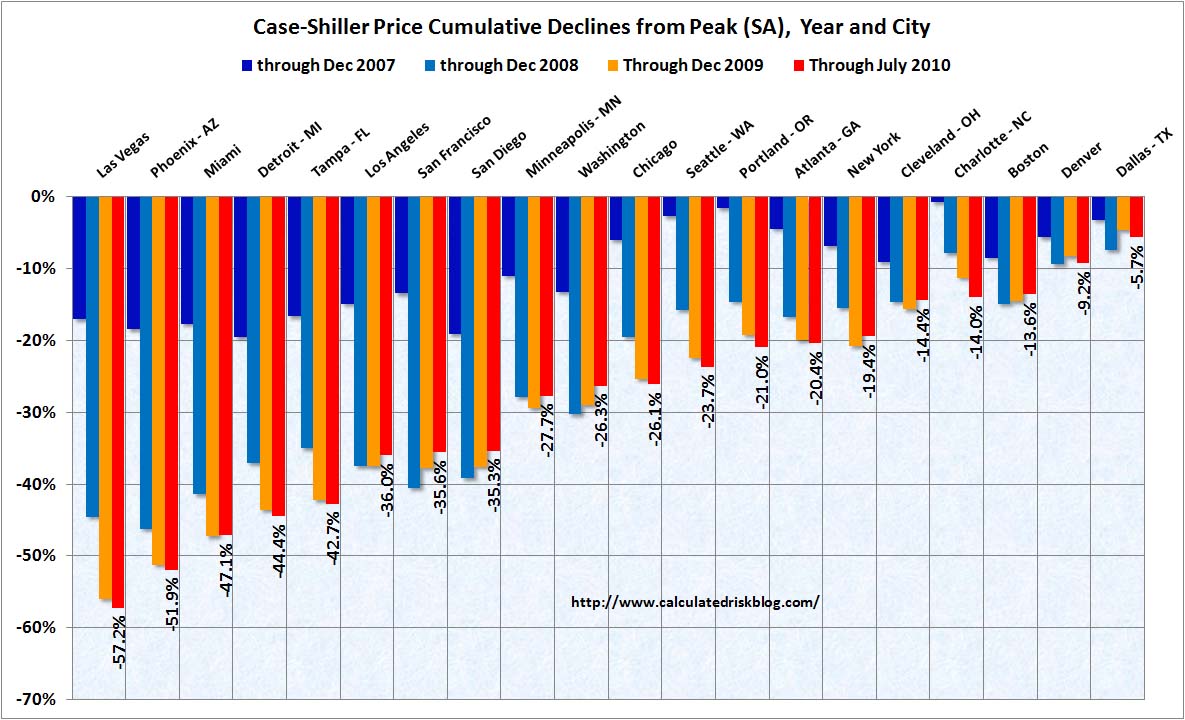

Here is the breakdown by Metropolitan Region

via Calculated Risk

>

Source:

Home Prices Remain Stable Around Recent Lows

28-Sep-2010 09:00

http://www.standardandpoors.com/indices/sp-case-shiller-home-price-indices/en/us/?indexId=spusa-cashpidff–p-us

What's been said:

Discussions found on the web: