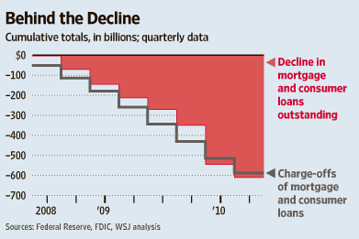

Real Time Economics references the Fed’s Z.1 Flow of Funds Accounts released Friday. What some economists have been assuming was Deleveraging was in fact Defaults:

“The sharp decline in U.S. household debt over the past couple years has conjured up images of people across the country tightening their belts in order to pay down their mortgages and credit-card balances. A closer look, though, suggests a different picture: Some are defaulting, while the rest aren’t making much of a dent in their debts at all.”

There are two ways, though, that the debts can decline: Pay them or default. The total value of home-mortgage debt and consumer credit outstanding has fallen by about $610 billion, to $12.6 trillion, according to the Federal Reserve. Of that $610 billion, “banks and other lenders charged off a total of about $588 billion in mortgage and consumer loans.”

So much for the great deleveraging . . .

>

Chart courtesy of Real Time Economics

>

Sources:

Defaults Account for Most of Pared Down Debt

Mark Whitehouse

Real Time Economics, September 18, 2010

http://blogs.wsj.com/economics/2010/09/18/number-of-the-week-defaults-account-for-most-of-pared-down-debt/

Z.1 Flow of Funds Accounts of the United States

Flows and Outstandings Second Quarter 2010

Federal Reserve, September 17, 2010

http://federalreserve.gov/releases/z1/Current/z1.pdf

What's been said:

Discussions found on the web: