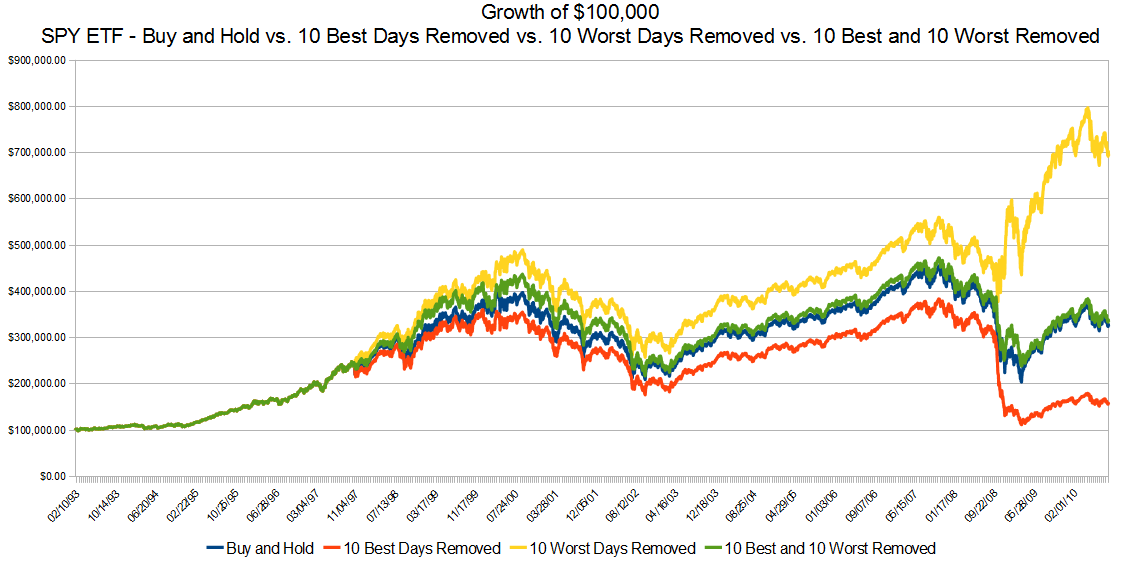

Mike Gayed of Pension Partners shares this chart with us:

>

SPX ETF 10 Best/Worst Days Removed

There are a few interesting observations about this data set:

• The 10 best days account for 50% of the buy and hold performance (roughly 0.2% of the days from 1993 to August 2010).

• Classic “Buy & Hold” nets $324,330.15

• Missing the 10 Best Days gives up more than 50% of the Buy & Hold performance: $156,354.12

• If you manage to avoid the 10 Worst Days, your portfolio more than doubles the Buy & Hold performance: $692,693.90

The lesson I take from this: It is great if you can avoid the major down days, but only if you can do so in a way that does not have you missing the major up days. If you manage to avoid all of the Worst days, but miss all of the Best days too, then your portfolio performance will be is nearly the same as straight Buy & Hold (but with additional taxes and commissions paid).

Now the reality is no one will consistently miss all the worst days — I’m the first guy to admit our 100% Cash call the day before the flash crash was dumb luck — but you can avoid being long for most of a secular bear market. If you can miss the longer downtrends, you end uop way ahead. Not drops that last days or weeks, but the secular months and quarters in the red.

That might be more challenging approach to chart — but its worth exploring . . .

What's been said:

Discussions found on the web: