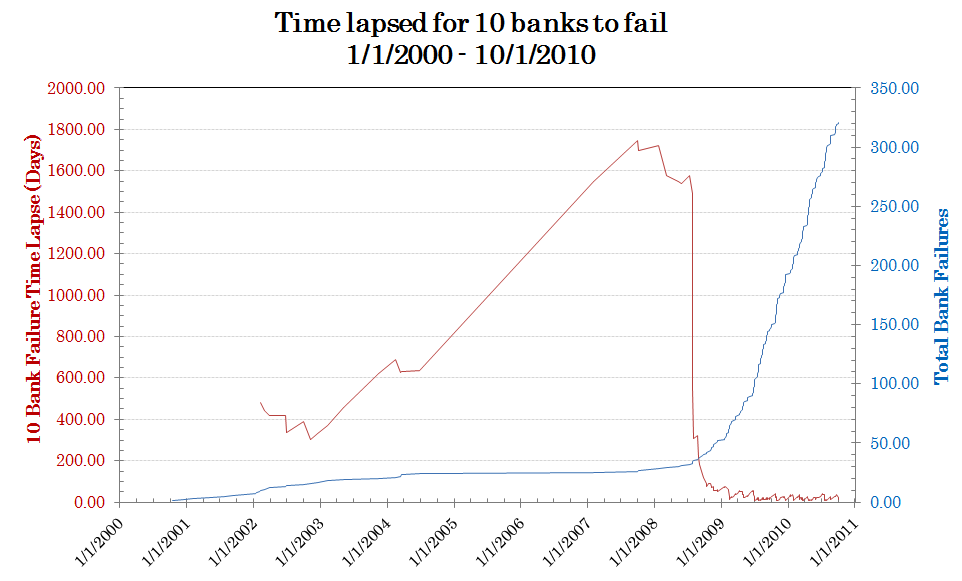

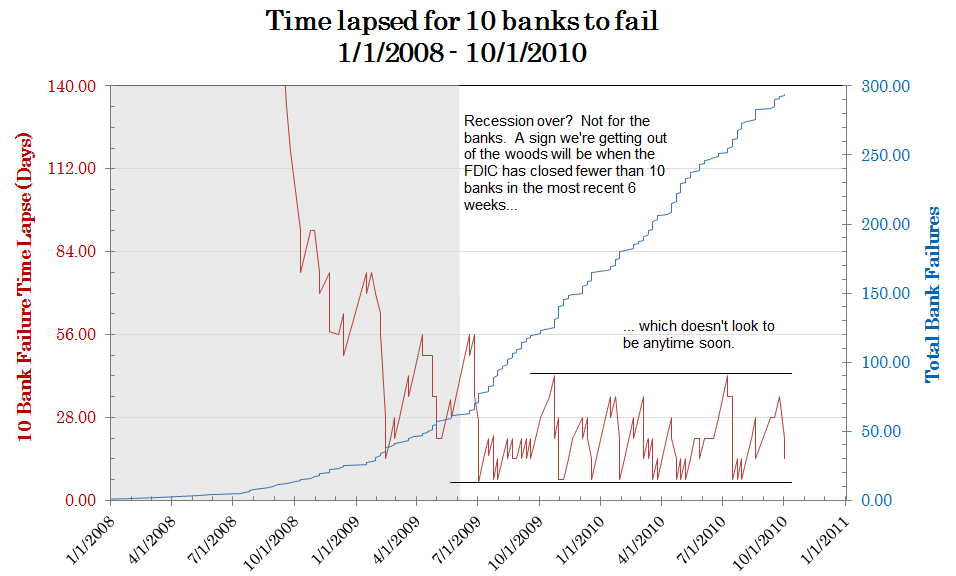

Wesley Allen, a Grad student at Purdue University, sends along these “bank failure plots” that show how long it takes the FDIC to close 10 banks during the recession.

The data shows that the banks are not out of the recession yet. If they can go 6 weeks with fewer than 10 bank failures, notes Wesley, then perhaps we can be more confident the financial sector is healing.

>

>

And for some context, here is the longer term 10 year view

>

Wesley further adds that there are additional notes to consider from the charts above:

1) Bank failures ARE NOT NORMAL. To those who say bank closures aren’t as bad as they were in ’09, we’re still closing banks left and right. The fact that we’re still asking “How many banks are they going to close this week?” instead of saying, “Woah! They closed a bank this week!” means we’re still in troubled waters.

2) Bank closures seem to come in waves every few weeks: one or two here, one or two there, and then a half-dozen at once.

3) Ironically, bank failures got a whole lot worse after the recession was over. (Is this a major trailing indicator or a dire foreshadowing of things to come?)

What's been said:

Discussions found on the web: