The nonpartisan Congressional Research Service prepared a report for Congress on the impact of the Bush Tax Cuts on the economy.

The report notes the various options of keeping some all or none of the cuts; the impact of these choices is the balance between fostering economic growth and restoring fiscal sustainability. (You can see the full CRS report here).

First, a definition: What exactly are the tax provisions of Bush Tax Cuts (EGTRRA and JGTRRA):

The Bush Tax Cuts

• The 10% tax rate was introduced;

• The 28% rate was reduced to 25%

• The 31% rate was reduced to 28%

• The 36% rate was reduced to 33%

• The 39.6% rate was reduced to 35%

• Long-term capital gains tax rate was reduced from 20% to 15%;

• Qualified dividends were taxed at 15% rather than as ordinary income;

• The “marriage penalty” was reduced by increasing the standard deduction for couples;

• Child tax credit, the earned income tax credit (EITC), and education incentives were expanded.

• Repeal of the personal exemption phaseout (PEP) and the limitation on

itemized deduction (Pease) (both were gradually phased out)

I cannot quantify the last three, but the others — the tax brackets, cap gains and dividends — are easy to understand.

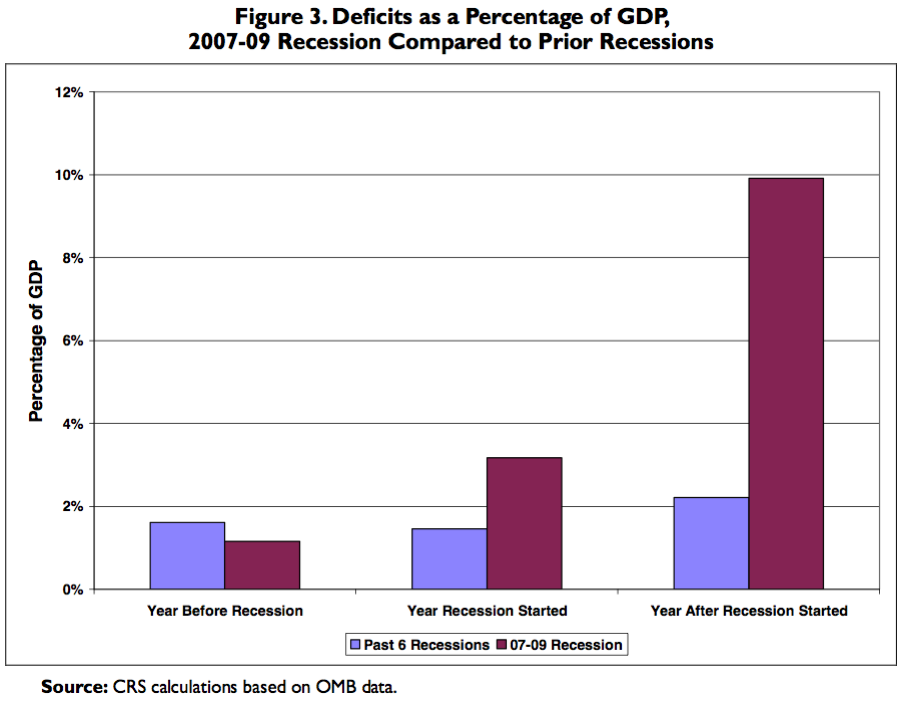

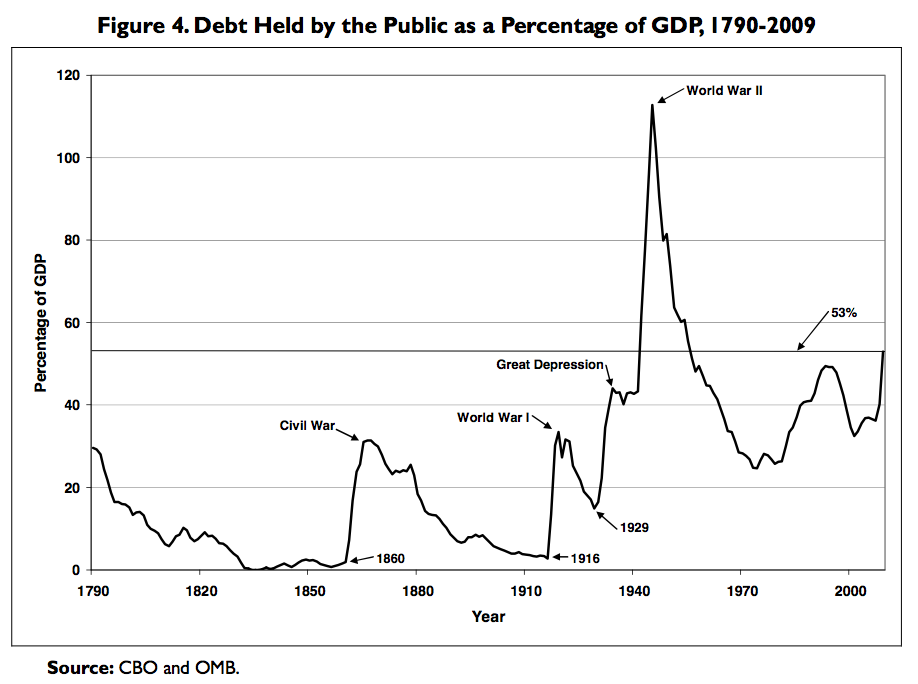

Here are several visual depictions of the circumstances from and impact of these taxes:

>

click for ginormous charts

You should read the full CRS report, as its quite informative . . .

Hat tip Bruce Bartlett

What's been said:

Discussions found on the web: