Alt. title: Barclay’s Algo + Waddell & Reed Futures Sale = Flash Crash?

Alt. title: Barclay’s Algo + Waddell & Reed Futures Sale = Flash Crash?

The 104 page report by the staffs of the U.S. Commodity Futures Trading Commission and the U.S. Securities and Exchange Commission CFTC & SEC was released this week (PDF here).

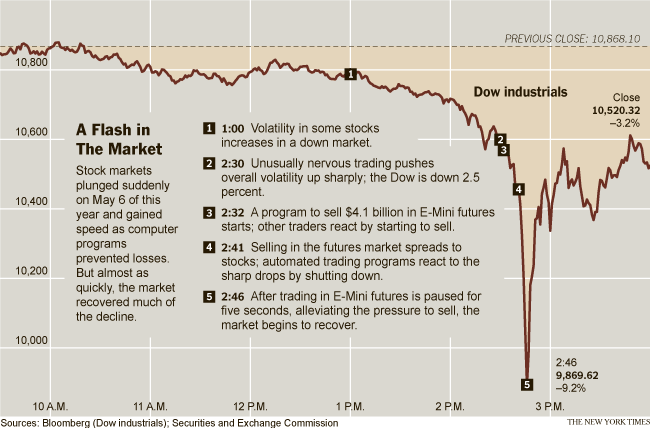

I am still digesting the entire writing, but a few things leaped out. The report states that the flash crash was set off:

“At 2:32 p.m., against this backdrop of unusually high volatility and thinning liquidity, a large fundamental trader (a mutual fund complex) initiated a sell program to sell a total of 75,000 E-Mini contracts (valued at approximately $4.1 billion) as a hedge to an existing equity position.”

The seller was Waddell & Reed, using a standard Barclays algo.

That may have been the spark that lit the fumes, but it does not address the structural flaws in the market which is the ongoing gas leak. Nor does it give us much confidence that it is unlikely to occur again soon.

Consider this WSJ description of how a SKYynet feedback loop developed and caused the crash:

“As the Waddell trade hit the futures markets . . . likely buyers included high-frequency trading firms. A key feature of high-frequency trading firms is that they quickly exit trades and, by 2:41, they were also aggressively selling the E-mini contracts they had bought from Waddell, which was still trying to sell the remainder of its contracts . . .

“HFTs began to quickly buy and then resell contracts to each other—generating a ‘hot-potato’ volume effect as the same positions were passed rapidly back and forth,” the report says. At one point, HFTs traded more than 27,000 contracts in just 14 seconds—a huge amount.The Waddell algorithm responded to the high volume by picking up the pace of its selling, even though stocks were spiraling lower. This feedback loop of selling by Waddell, high-frequency traders and others helped drive the E-mini price down 3% in just four minutes.”

What I read into this is a system devoid of human judgment or rules as the underlying structural factor.

There is no adult supervision, only bots and silicon. Instead of putting SKYnet in charge of national defense, we have put it in charge of our markets and economy. The end result — minus the spectacular special effects — seems to have been the same.

Over my career, I have criticized specialists for raping and pillaging various orders at will. But a system without humans charged with maintaining orderly markets, with software bots swapping shares with other silicon-based life forms, is what has replaced that. Perhaps the cost of orderly markets was the specialist’s license to steal.

Meanwhile, SKYnet sits . . . and waits.

>

May 6 2010 Trading

click for larger chart

chart courtesy of

NYT

>

Sources and additional reading:

How a Trading Algorithm Went Awry

TOM LAURICELLA, KARA SCANNELL And JENNY STRASBURG

October 2, 2010

http://online.wsj.com/article/SB10001424052748704029304575526390131916792.html

Lone $4.1 Billion Sale Led to ‘Flash Crash’ in May

GRAHAM BOWLEY

NYT, October 1, 2010

http://www.nytimes.com/2010/10/02/business/02flash.html

Waddell Shows Long-Term Fund Can Unhinge Wall Street

Christopher Condon

Bloomberg, October 1, 2010

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aRYGlcV.CmQA

Futures Sale Spurred May 6 Panic as Traders Lost Faith in Data

Nina Mehta and Whitney Kisling

Bloomberg, October 2, 2010

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=aq8F5AttHvy8

What's been said:

Discussions found on the web: