The rich are different. They not only have more money, they perceive the world and the economy very differenly than you do. Indeed their entire psychological outlook is decidedly different.

At least, that is what a recent Merrill Lynch survey (September 13 –October 7) found. Affluent Americans — those with more than $250,000 in investable assets — are feeling more confident about their finances than they did a year ago:

• 41% of affluent Americans feel financially better off today than they did one year ago;

• More than three out of four (78%) are confident that their financial picture will improve in the year ahead.

• 61% expect to retire later than originally planned, an increase from 29% in January 2010

During the last year, one in five (20%) affluent Americans indicated having to tap into their long-term savings/investments to meet short-term needs:

-35% Cover regular monthly expenses

-27% Pay off excess debt

-19% Compensate for a loss in income within the family

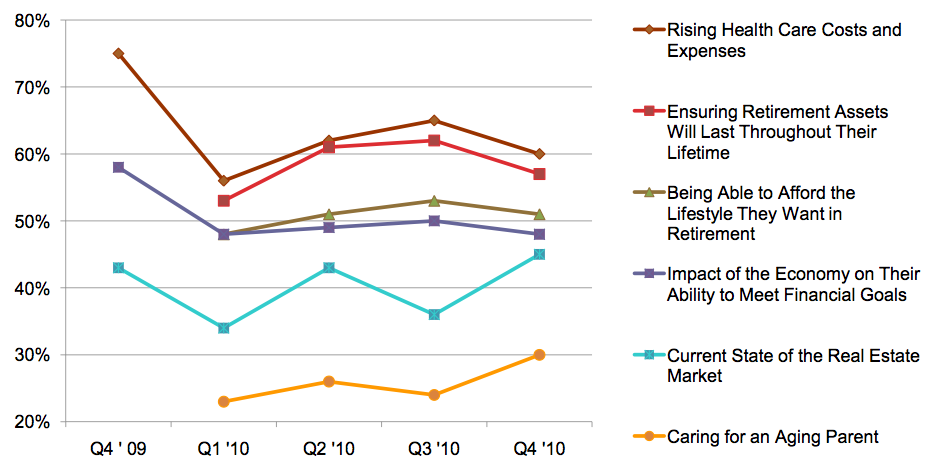

Top financial concerns continue to be the rising costs of health care and whether retirement assets will last throughout their lifetime; while concern about caring for aging parents is also on the rise:

-Rising Health Care Costs and Expenses

-Ensuring Retirement Assets Will Last Throughout Their Lifetime

-Being Able to Afford the Lifestyle They Want in Retirement

-Impact of the Economy on Their Ability to Meet Financial Goals

-Current State of the Real Estate Market

-Caring for an Aging Parent

>

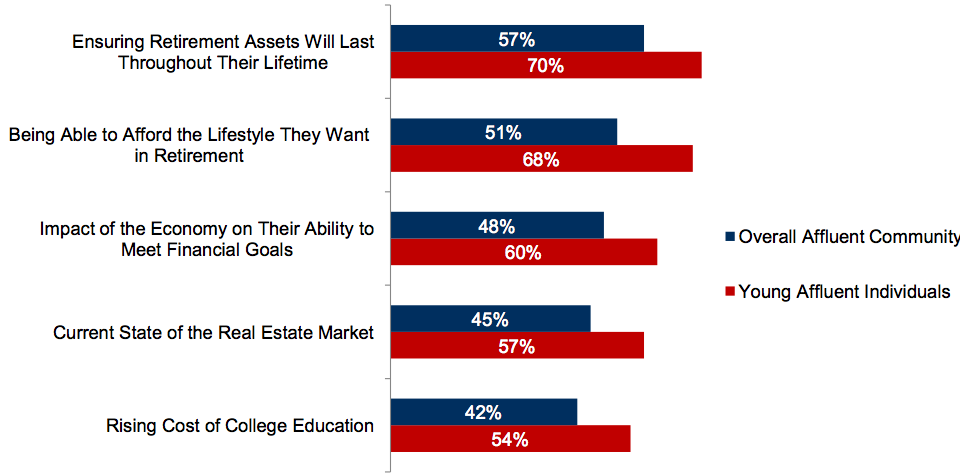

Younger affluent individuals age 18 –34 (mean age 31) are more concerned than other segments of the affluent population about many financial issues:

Source: Phone survey conducted by Braun Research from September 13 –October 7

What's been said:

Discussions found on the web: