Invictus here.

I’m simply unable to resist the temptation to weigh in on the Sarah Palin v. Ben Bernanke QE2 inflation controversy. I’m drawn to the intersection of economics and politics like a moth to a flame. So apologies to those who read BR’s post on this and are now subjected to my take.

It appears to have started when National Review excerpted part of a Palin speech. The part to which I take exception is this (emphasis added):

All this pump priming will come at a serious price. And I mean that literally: everyone who ever goes out shopping for groceries knows that prices have risen significantly over the past year or so.

Her bold (and bolded) claim is simply not supported by the facts. The BLS reports — see Series CUSR0000SAF11, U.S. City Average, Food At Home (i.e. groceries) — that inflation over the past 12 months has run at 1.4 percent, hardly a “significant rise” by historical standards (unlike mid-2008). To be sure, some items have gone up, others have gone down, as is always the case. And one can drill down into the numbers and find whatever signs of inflation — or deflation — they’d like. There are dozens, if not hundreds, of items from which to choose. But the point remains that, on the whole, 1.4 percent is hardly runaway grocery inflation.

The Wall St. Journal’s Sudeep Reddy rightly called BS on Palin’s claim, to which she responded with a pile of self-deprecating, aw-shucks-I’m-just-an-ex-governor-and-homemaker nonsense (“I’m just a former governor and current housewife from Alaska, but even humble folks like me can read the newspaper. I’m surprised a prestigious reporter for the Wall Street Journal doesn’t.” Of course, reading and comprehending are two very different things). That exchange is here. In it, Palin tries to club Reddy over the head with an article that appeared in his own paper and in so doing proves that Reddy was, in fact, right in criticizing her factually challenged statement. Palin writes:

Mr. Reddy takes aim at this [ed. note: Refers to her inflation claim]. He writes: “Grocery prices haven’t risen all that significantly, in fact.” Really? That’s odd, because just last Thursday, November 4, I read an article in Mr. Reddy’s own Wall Street Journal titled “Food Sellers Grit Teeth, Raise Prices: Packagers and Supermarkets Pressured to Pass Along Rising Costs, Even as Consumers Pinch Pennies.”

The article noted that “an inflationary tide is beginning to ripple through America’s supermarkets and restaurants…Prices of staples including milk, beef, coffee, cocoa and sugar have risen sharply in recent months.”

First off, note that the article she cites states that an “inflationary tide is beginning to ripple…”. Not that it has rippled — past tense — but that it is beginning to ripple now, and may (or may not) pose a threat in the future.

More significantly, though, note Palin’s use of the ellipsis, indicating that something followed behind the word “restaurants.” What was it? It was this: “…threatening to end the tamest year of food pricing in nearly two decades.”

That’s right: The year in which Ms. Palin claims grocery prices had “risen significantly” was, according the very article she cited to try to discredit Reddy, the “tamest year of food pricing in nearly two decades.” By removing that from her excerpt, she completely changed the meaning of the original article.

Finally, I’d note that Palin had plenty of opportunity to opine about grocery inflation when it was a legitimate issue during her vice presidential run (see table above). I don’t recall her doing so.

The larger issue, of course, is that many millions more Americans will be aware of Palin’s comment than will ever be of Reddy’s proper takedown of it, and thus history will be rewritten to reflect a “significant rise” in grocery inflation from the period covering Fall 2009 – Fall 2010.

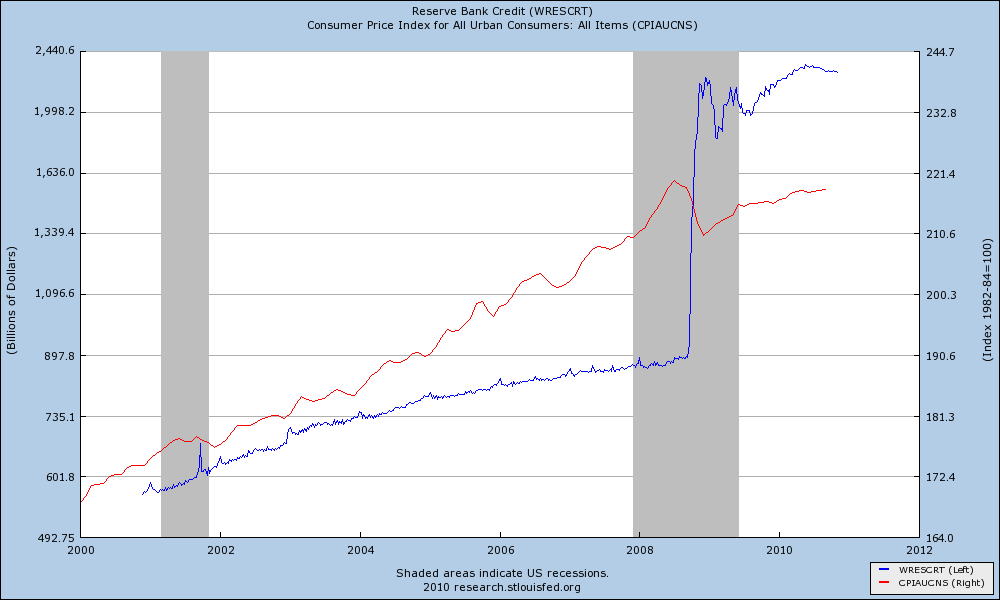

Below is a chart of how inflation and the Fed’s balance sheet (unavailable at FRED, but according to my FRED contact best approximated by Reserve Bank Credit) have correlated over the years, most importantly during the inital ~$1.5 trillion expansion of its balance sheet. That tripling of the Fed balance sheet (almost all of which came with a Republican in the White House and nary a peep from the right) was a ho-hum event as far as inflation was concerned. This $600 billion, undertaken with a Democrat in the White House, will be the end of life as we know it.

P.S. I’m not sympathetic to the all-government-statistics-are-manipulated/useless/rigged argument, and will not engage commentary on that front.

ADDING: BLS measures by weight/volume, and reductions of package sizes would not alter their results. Below is a typical example:

What's been said:

Discussions found on the web: