Even in the age of Viagra, 3X is a bit much for a tired country not operating at full capacity. Yet that is what we are facing, with a third throw for the week, as we get non-farm payroll data at 8:30am this morning.

The report is likely to highlight the Fed’s jobs concerns, with Unemployment remaining sticky, near 10%. Unemployment has been at or above 9.5% since August 2009 — an unfortunate record since monthly NFP data keeping began six decades ago.

A Bloomberg survey of economists predicted that payrolls rose by 60,000; Estimates for the jobless rate ranged from 9.5 to 9.7%. Over the past year, hourly earnings grew only at 1.6%, and there is little expectation that wages will grow appreciably.

The best bet for gains will be the seasonal retail hiring. The Xmas ad blitz started early this year, beginning before Halloween. That implies heavy promotion, and heavier discounting.

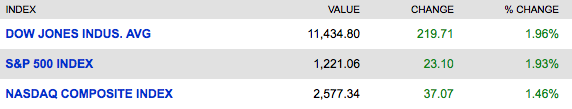

The US has lost more than 8 million jobs this recession, making it the worst economic contraction since the 1930s. But there is a disconnect between the soft job market/weak economy and the rocketing stock market. This is confounding some people, as markets have hit their Pre-Lehman levels:

The belief that gains in the markets can improve the overall economy in a post-credit crisis environment is rather naive.

The focus on equity prices is a corollary to the Wisdom of Crowds, and the data supporting it is inconsistent at best. There have been far too many instances in history of markets rallying 30%, 50%, even 125% — with economies failing to gain any traction.

>

Employment situation is out at 8:30am

What's been said:

Discussions found on the web: