One of the more annoying clichés of the past year has been ““The markets hate uncertainty.” You can always tell when you are listening to an empty-headed pundit when they trot out that old saw.

This morning, I have a Bloomberg column on that exact subject, titled “Kiss Your Assets Goodbye When Certainty Reigns.” (or, if you prefer, the older noir version of Bloomberg).

Here is an excerpt:

When Certainty Rules

Recall the dot-com era, when everyone knew that profits no longer mattered. Uncertainty seemed to be banished. An epic crash followed.

After the Internet implosion, the opposite extreme was operational: Profitable, debt-free tech companies were being traded for less than book value. In a few rare instances, they were being sold for less than cash on hand. Investors had become certain that a dollar was worth only 75 cents.

There was little uncertainty heading into the March 2009 stock-market lows. Almost everyone was sure the world was falling into the abyss. In that massive and indiscriminate selling, it seemed almost certain that no one was ever going to buy another house or car, or send their kids to school, or for that matter, clothe or feed them. How did the consensus work out in that instance?

No Reward

When we discuss uncertainty, what we are really discussing is risk. All unknown outcomes contain risk, and therein lies the possibility of loss. Risk is inherent in the concept of uncertainty. However, anyone looking for performance must embrace risk, for without it, there can be no reward.

Uncertainty is what makes alpha, or market-beating gains, possible. Smart traders know that uncertainty is where the money is. No uncertainty, no risk; no risk, no possibility of outperformance.

Since July, when the Era of Uncertainty began, the Morgan Stanley Cyclical Index — those businesses most closely tied to this uncertain economy — is up 26 percent.

Want some certainty? Go buy yourself Treasuries. You can pick up a very lovely two-year bond yielding 0.41 percent. (Good luck charging two and 20 on that!)

You can read the entire thing here (or here).

I will be discussing this on Bloomberg TV with Betty Liu at 9:15 am; then on Tom Keene’s Radio show right after.

>

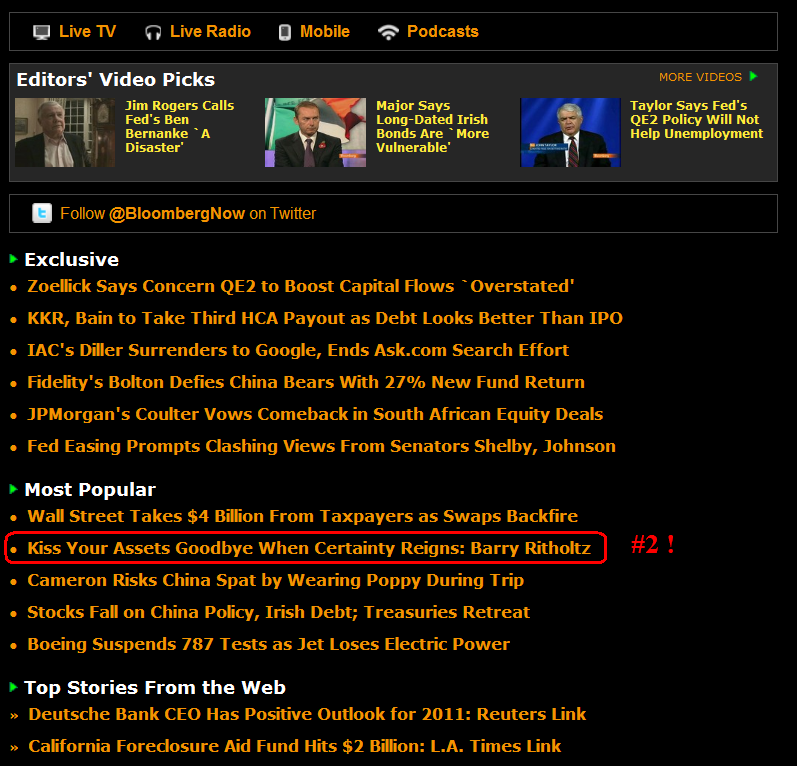

UPDATE: November 10, 2010 3pm

Hey, its the 2nd most popular article on Bloomberg !

>

Source:

Kiss Your Assets Goodbye If Certainty Reigns

Barry Ritholtz

Bloomberg, Nov 9, 2010 9:00 PM ET

http://www.bloomberg.com/news/2010-11-10/kiss-your-assets-goodbye-if-certainty-reigns-commentary-by-barry-ritholtz.html

What's been said:

Discussions found on the web: