I have been a fan of Felix Zulauf’s approach to investing for many years. The longstanding Barron’s roundtable member is a straight shooter, with a superlative track record. That was why I was thrilled to do an extensive interview with this Summer (Interview, Transcript).

Felix is advising on a new fund (Disclosure: We are investors in that fund). He describes the fundamental beliefs that drive his investment philosophy:

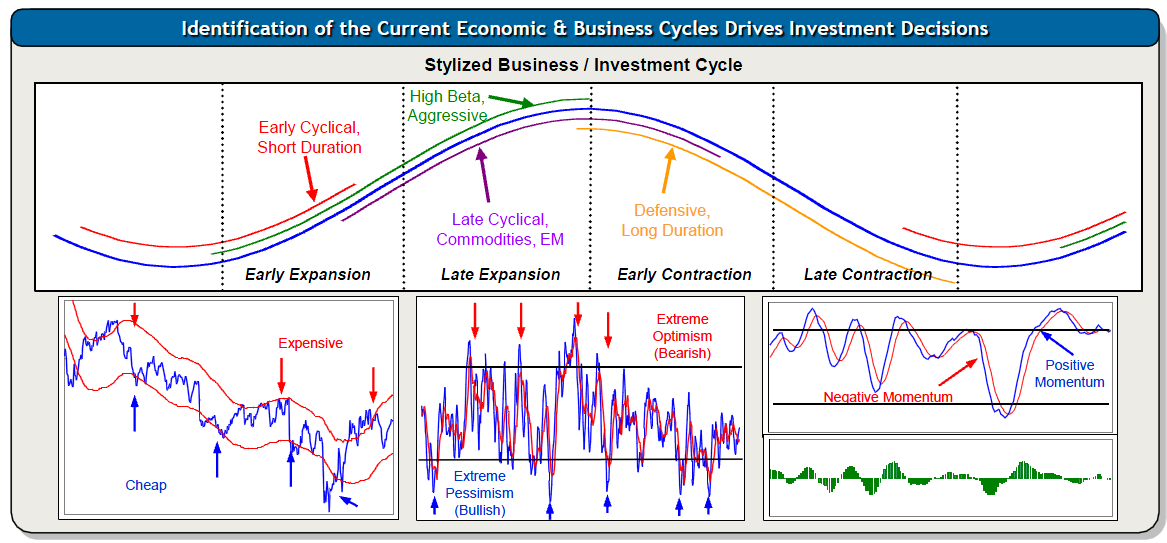

• Cyclicality: Economies and markets move in recurring cycles;

• Valuation: Relative valuation between asset classes reverts to a mean over long periods of time;

• Sentiment: Sentiment is a useful contrary indicator, especially at extremes;

• Momentum: Over the medium term, cyclical trends can develop their own sustaining momentum;

• Risk Management: Minimizing losses and managing exposure are crucial components of positive returns;

The way these factors play out over time can be seen in the following graphic depicting the various phases of the investment cycle:

>

What's been said:

Discussions found on the web: