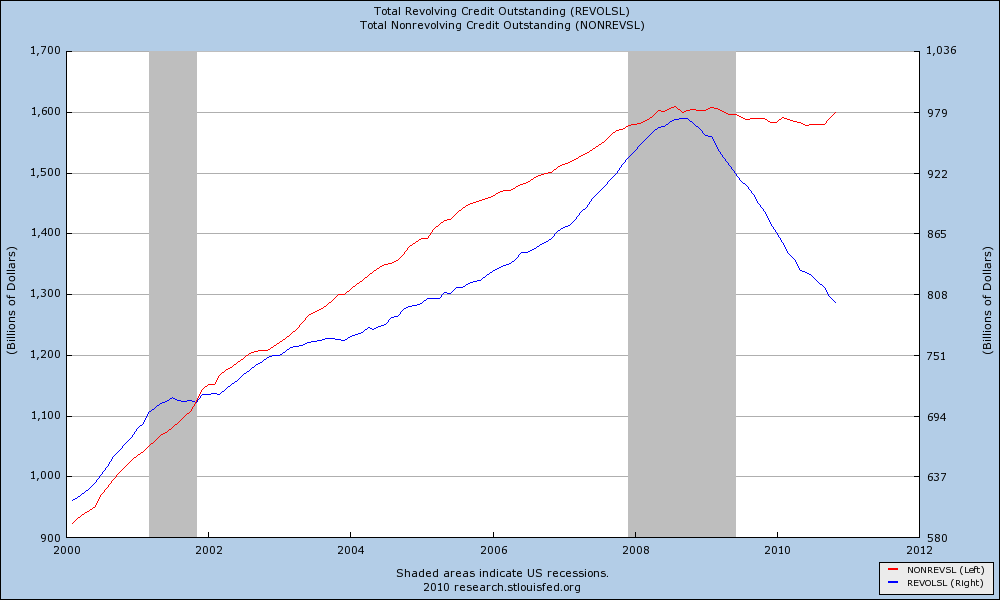

The Fed released its report on consumer credit, and it comes as no surprise that revolving credit eased for the 26th consecutive month as consumers continue to shed credit — either by paying it down or, in some cases, walking away from it. From a high of $973.6 billion in August 2008, revolving credit has contracted by $173.1 billion to $800.5 billion (a level last seen six years ago, in December 2004). It is an annualized rate of decline of about 17.75%. Nonrevolving credit has been flatlining over the same period:

Correction: Thanks to Ron Griess for pointing out some sloppiness in my post: The 17.75% decline to which I referred is not the annualized rate of decline — it is the peak-to-now overall decline. The annualized rate of decline, as Ron correctly points out, is -8.64%. I apologize for the sloppiness. My mind is apparently already on vacation. Thanks, Ron.

>

What's been said:

Discussions found on the web: