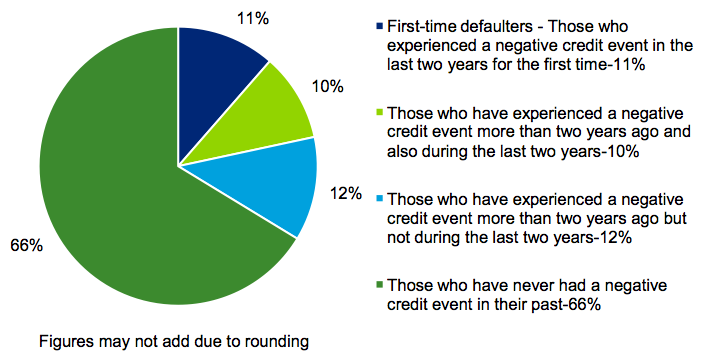

The new “first time defaulter” is the takeaway from a recent survey by Deloitte. The major points:

• Individuals who have gone through at least one serious negative credit event in the last two years for the first time in their lives.

• 22% of Americans with bank accounts experienced a serious negative credit situation during the last two years. For fully 11%, this was a new experience — the first time in their lives they fell into delinquency. [Editor’s note: 22% is a stunning number to me; 11% is not far behind in terms of shock value.]

• Unemployment and reduced income were the principal reasons why these individuals have failed to meet their credit obligations.

• Many first-time defaulters rated their interactions with lenders during their negative credit event as “poor.” This dissatisfaction may strongly encourage them to look elsewhere when borrowing in the future.

• If not for the economic recession, which has affected millions of households in America, many of the first-time defaulters might have remained in good credit standing.

>

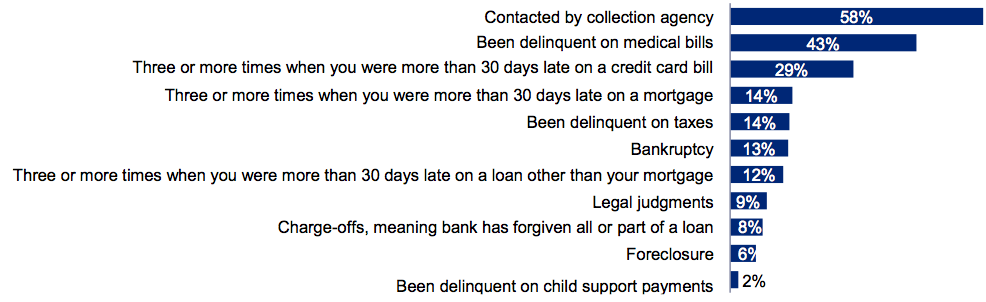

Negative credit experience during the last 2 years (1st-time defaulters)

>

What's been said:

Discussions found on the web: