Bloomberg reported yesterday that the Derwent Absolute Return Fund was seeded with an initial 25 million pounds ($39 million) and will begin trading in February.

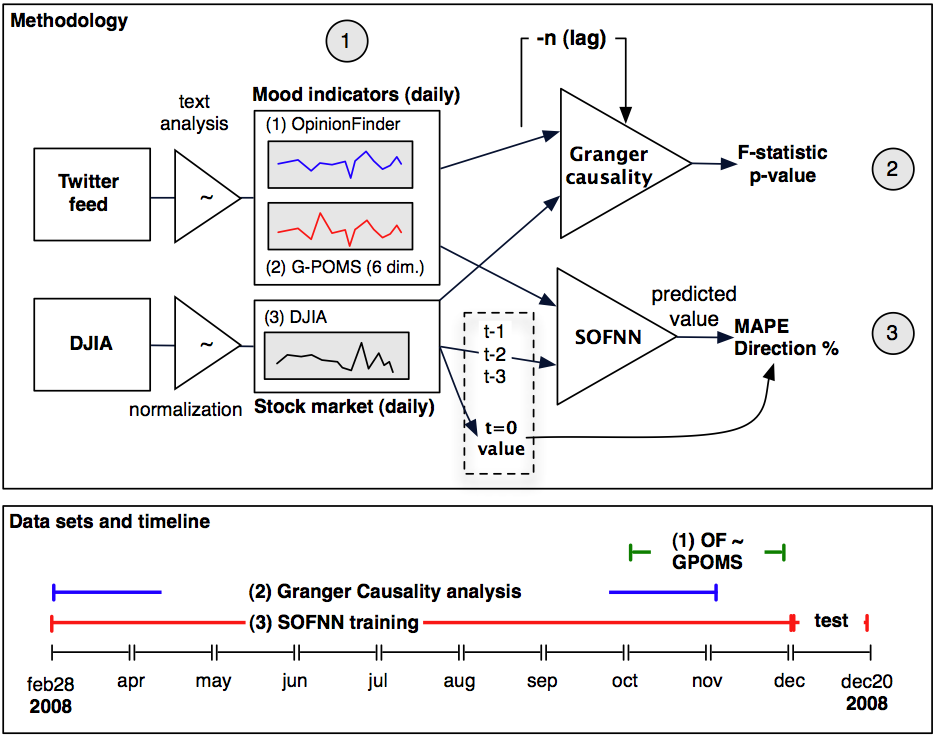

Its model? Following posts on Twitter, and tracking emotionally significant words to anticipate the market’s next jag up or down. A recent study concluded that short term market moves can be anticipated this way with a high degree of confidence.

I am all in favor of innovative new ways to slice data, and this one looks fascinating. However, before I jump into this with both feet, I do have some reservations. The sample set of a few short months of Twitter vs the Dow is way small — the research measured the public mood by searching Twitter posts from February to December 2008 for synonyms of and language related to six moods: calm, alert, sure, vital, kind and happy.

I am all in favor of innovative new ways to slice data, and this one looks fascinating. However, before I jump into this with both feet, I do have some reservations. The sample set of a few short months of Twitter vs the Dow is way small — the research measured the public mood by searching Twitter posts from February to December 2008 for synonyms of and language related to six moods: calm, alert, sure, vital, kind and happy.

That period in 2008 incorporating the collapse of Bear Stearns and the September market collapse was not exactly typical. Indeed, the monkeys were unusually agitated during this time. This model will need to prove itself during periods of normal volatility and sentiment.

Still, it would not surprise me if the Twit stream reveals some consensus about the mood of the monkeys. At extremes, that could be an assist in developing a trading thesis about intermediate term highs and lows.

My working assumption is the primate factor — human emotions — is immutable, but the other factor is the changing ways the technology is applied, deployed, etc. may have an impact on the quantified sentiment reads. Already, outfits like StockTwits have a dedicated user base of active traders, and their perspectives may not parallel the public’s mood.

There have been a variety of start up attempts to capitalize on this, but so far, none seem to have found the magic formula. Going straight to Twitter bypasses all of that.

Sentiment is an important part of my model, but only at extremes. I wonder if it can be used to manage day-to-day trades. I am skeptical, but willing to consider this if it can show some trade efficacy.

>

>

Sources:

Twitter mood predicts the stock market

Johan Bollen, Huina Mao, Xiao-Jun Zeng

http://arxiv.org/PS_cache/arxiv/pdf/1010/1010.3003v1.pdf

Hedge Fund Will Track Twitter to Predict Stock Moves

Jack Jordan

Bloomberg, December 22, 2010

http://noir.bloomberg.com/apps/news?pid=newsarchive&sid=a0HeKpjwajW8

Computers That Trade on the News

GRAHAM BOWLEY

NYT, December 22, 2010

http://www.nytimes.com/2010/12/23/business/23trading.html

What's been said:

Discussions found on the web: