I was speaking to Pete, my head trader yesterday. I asked him if he thought traders would jump on any tax deal. His answer? Only if people traders are foolish.

Turns out we have both a deal and a rollicking response from the traders.

The deal:

• Extend all Bush income tax cuts for two years

• Reduce worker payroll taxes for one year (4.2% in 2011, from the current 6.2% rate)

• More favorable treatment to business investments

• Temporary reinstatement of the estate tax at 35%; 5 million estates and under exempt from estate tax

• Extension of jobless benefits for the long-term unemployed.

The response:

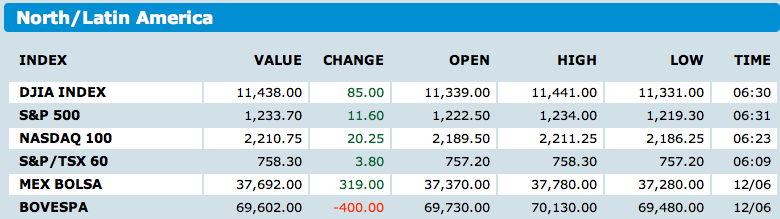

Stocks rose, copper (+2.8%) and gold (+1%) climbed to all-time highs. Treasuries fell. The Dollar Index slipped. Bloomberg reported US actions are “offsetting concern that Europe’s debt crisis will spread further.” European stocks gained 1.2%.

Across the pond, the EU is about to formally approve Ireland’s bailout (no word on Portugal or Spain).

The year end melt up continues. I suspect we have just taken a major step towards suckering in mom and pop — leading us ever closer to that elusive denouement.

Its a fair guess that any top has been pushed deeper into 2011 . . .

>

What's been said:

Discussions found on the web: