Invictus reporting for duty.

In view of the release of the FCIC report, specifically the reported implication that Ben Bernanke shares the blame (which he no doubt does), it brought to mind the small step I took to try to stop the madness in 2005:

On August 9, 2005, Al Hubbard, Director of the National Economic Council, and Ben Bernanke, Chairman of the Council of Economic Advisors, held a press briefing. Very shortly after reading the transcript, I sent the following letter to Dr. Bernanke (and yes, quaint though it may seem, I really did write to Bernanke. Just call me a starry-eyed dreamer.):

On August 9, you participated in a press briefing during which you fielded questions about your meeting with the president.

Among the questions you were asked was this one:

Did the housing bubble come up at your meeting? And how concerned are you about it?

Your answer, in part, follows [emphasis mine]:

We talked some about housing. There’s a lot of good news on housing. The rate of home ownership is at a record level, affordability still pretty good.

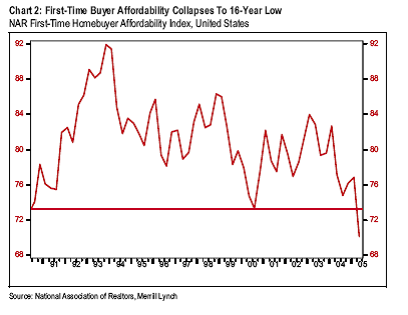

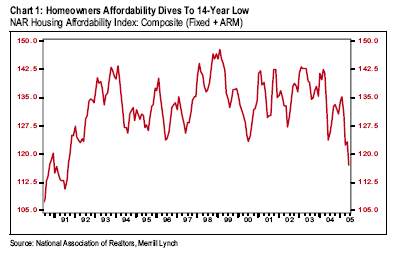

I have reproduced below two charts created by brokerage firm Merrill Lynch using data compiled from the National Association of Realtors.

The charts speak for themselves: First-time buyer affordability has collapsed to a 16-year low, and overall homeowner affordability has plunged to a 14-year low.

So my question is simply this: Given the hard data, on what basis did you make the claim that housing affordability is “still pretty good”?

Thank you.

Sadly, but not unexpectedly, I never did receive a reply.

What's been said:

Discussions found on the web: