No surprise here:

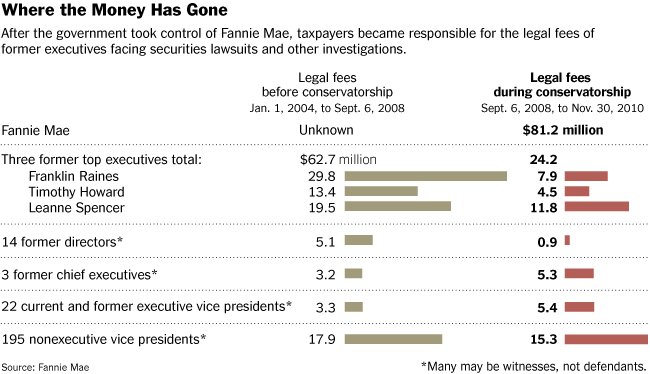

“Since the government took over Fannie Mae and Freddie Mac, taxpayers have spent more than $160 million defending the mortgage finance companies and their former top executives in civil lawsuits accusing them of fraud. The cost was a closely guarded secret until last week, when the companies and their regulator produced an accounting at the request of Congress.

The bulk of those expenditures — $132 million — went to defend Fannie Mae and its officials in various securities suits and government investigations into accounting irregularities that occurred years before the subprime lending crisis erupted. The legal payments show no sign of abating . . .

Although the figures are not broken down by case, the largest costs are being generated by a lawsuit centering on accounting improprieties that erupted at Fannie Mae in 2004. This suit, a shareholder class action brought by the Ohio Public Employees Retirement System and the State Teachers Retirement System of Ohio, is being heard in federal court in Washington. Although it has been going on for six years, the judge has not yet set a trial date. Depositions are still being taken in the case, suggesting that it has much further to go with many more fees to be paid.”

A corrupt, mismanaged firm with an implied government guarantee — how could that ever go wrong?

>

>

Source:

Mortgage Giants Leave Legal Bills to the Taxpayers

GRETCHEN MORGENSON

NYT, January 24, 2011

http://www.nytimes.com/2011/01/24/business/24fees.html

What's been said:

Discussions found on the web: