Food for thought:

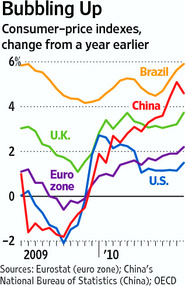

While high unemployment and spare capacity are restraining underlying inflation pressures in the U.S. and elsewhere in the developed world, annual inflation in China is almost 5%—and a sizzling 9.8% economic growth rate in the fourth quarter triggered fears of more price pressures ahead. Inflation in Brazil is even higher.

With the global recovery still in its early stages, those moves could accelerate. Higher raw material prices, especially coal and iron ore, are pushing up steel prices across the globe. Steelmakers including AK Steel and Nucor in the U.S., and China’s Baosteel and South Korea’s Posco—the world’s second and third largest—have been steadily increasing prices in recent weeks. The world average carbon-steel price is forecast to exceed $1,000 per metric ton by the second half of 2011, up from an average $733 last year, according to U.K.-based consultancy MEPS . . .

Global inflation isn’t just coming from volatile commodities that track the ups and downs of the world economy. Fast-growing emerging nations are taking increasingly aggressive actions to beat back rising food prices as they grow more worried about threats to stability.”

As noted last week, cattle prices were stampeding. This definitely bears watching.

>

Source:

Global Price Fears Mount

By BRIAN BLACKSTONE And MARCUS WALKER

WSJ, January 24, 2011

http://online.wsj.com/article/SB10001424052748703398504576099680269779402.html

What's been said:

Discussions found on the web: