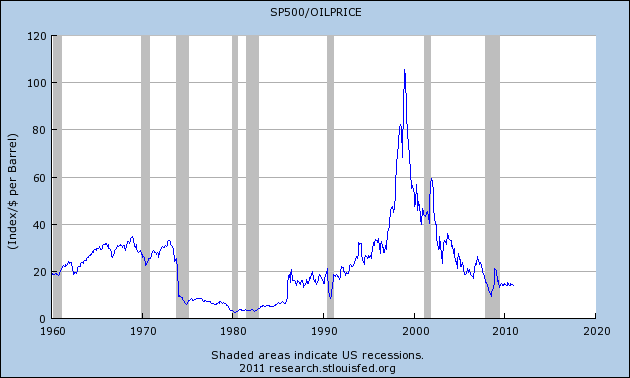

I’ve been wondering recently at what point the price of oil might have the potential to impede the advance of the S&P 500, figuring that sooner or later the market would have to take notice. So it was off to FRED to see what history might teach me. I confess I was a bit surprised by what I found:

>

Based on what I found, I’d have to conclude that whatever correction we get in the stock market — which of course must come sooner or later — will likely not be triggered by the price of oil, as the market’s multiple in OILPRICE is about on par with its historical average and well below the peak we saw in 1999-2000.

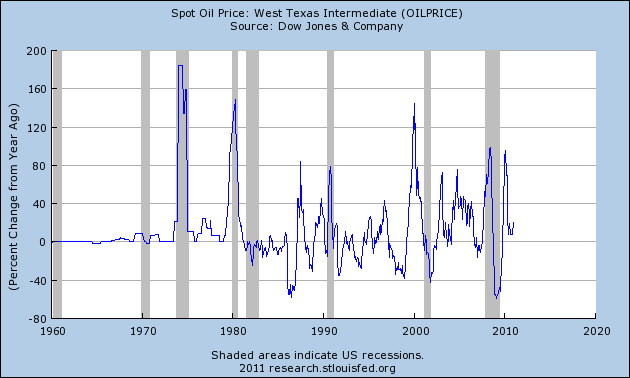

UPDATE: For those in comments mentioning “rate of change,” here’s year-over-year for WTI (currently 19.8% and rising):

What's been said:

Discussions found on the web: