A mere technicality, my good man!

WSJ:

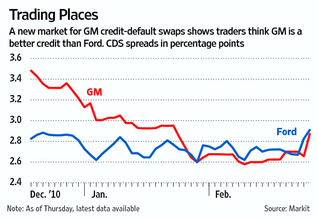

“Banks and hedge funds are trading credit-default swaps, which make payments to holders of General Motors bonds in the event of a default. But GM canceled $40 billion of debt in bankruptcy and has pledged to cut its remaining $4.6 billion bank loan to the bone this year.

That is merely a technicality for the banks and hedge funds that have been actively trading the CDS.

That is merely a technicality for the banks and hedge funds that have been actively trading the CDS.”

When it comes to derivatives, the fun never ends . . .

>

>

Source:

Wall Street Bets on Debt That Doesn’t Exist

MATT WIRZ And KATY BURNE

WSJ, FEBRUARY 28, 2011

http://online.wsj.com/article/SB10001424052748704430304576170710897188504.html

What's been said:

Discussions found on the web: