Today’s must read MSM piece is the WSJ discussion of Inflation:

“The pace of consumer price increases in the U.S. is quickening after being dormant for months. But a tug of war between the prices of goods and the prices of services, playing out beneath the surface, could keep inflation from becoming the worry it is in China, Europe and many emerging markets.”

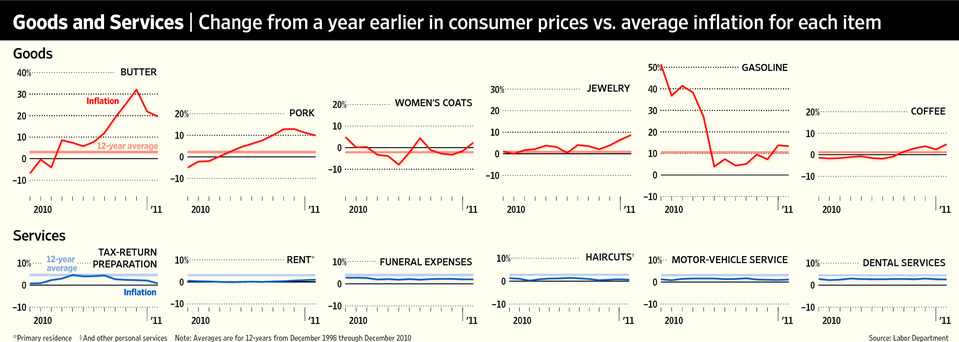

Prices rose 1.6% in January 2011 vs 2010 — the biggest increase in eight months. The key has been commodities — gasoline, cotton, wheat, coffee, and oil are all higher.

Labor, on the other hand is not. Wages are flat, unemployment is stubbornly high, and hence, prices for Services are flat to lower. That is keeping a lid on inflation.

Hence, the dueling deflation versus hyper-inflation commentaries:

“Soaring commodities costs world-wide are pushing up prices for many goods, while a slowly recuperating U.S. economy, soft housing market and a persistently high unemployment rate are holding down prices for U.S. services.

Goods prices were up 2.2% from a year earlier, paced by jumps in food and energy prices, according to the Labor Department’s January consumer-price index, and are rising faster than they did before the recession. But services prices were up only 1.2% from a year earlier, far below the 3.4% inflation rate registered for services between 2000 and 2008.

The opposing pull of prices for goods and services could have a big effect on the course of U.S. inflation. Federal Reserve Chairman Ben Bernanke is betting that rising prices for goods like gas and food will not spread into the broader economy. He and many private forecasters do not expect the U.S. to see the kind of rising inflation now plaguing China, India and other parts of the world.

Goods inflation has outstripped services inflation for long stretches since mid-2007, something that hadn’t happened since the 1970s. For most of the last 30 years, goods prices had been held down, in part, by cheap imports from low-wage countries like China. But recently, China and other developing markets have become huge consumers of commodities, which is putting upward pressure on American prices for many globally traded goods.”

Well worth reading in its entirety.

>

>

Source:

Split in Economy Keeps Lid on Prices

JON HILSENRATH And JUSTIN LAHART

WSJ, February 18, 2011

http://online.wsj.com/article/SB10001424052748703312904576146500586838290.html

What's been said:

Discussions found on the web: