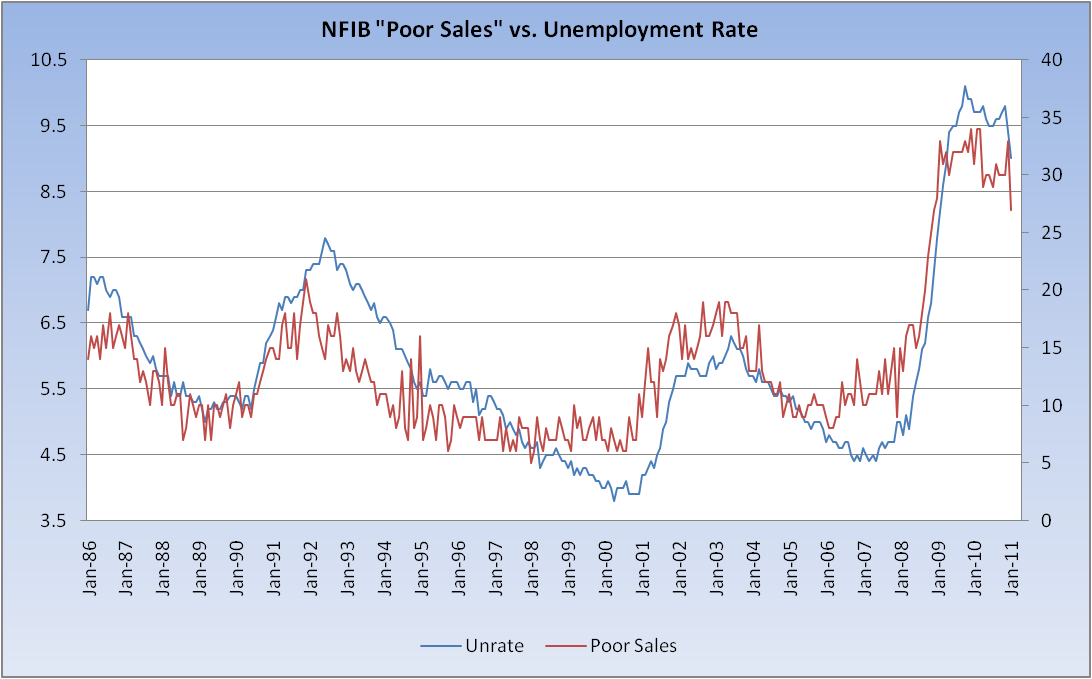

The interesting — and high (0.86) — correlation between the “Poor Sales” component of the NFIB’s SBET and the nation’s unemployment rate was evident yet again this month: Last week we saw the unemployment rate drop a dramatic 0.4 percentage points (although the noise and cross-currents in the report were sufficient to render it virtually useless), and today we witnessed the NFIB’s “Poor Sales” component drop a sharp 6 points from last month, from 33 down to 27, the lowest reading for this metric since December 2008, and among the largest drops on record. Although the NFIB’s report was a mixed bag, there were some positive takeaways (the overall index increased (94.1), and the aforementioned decline in Poor Sales as the single biggest problem, among others).

(Click through for ginormous)

Previous large declines in Poor Sales took place in Feb 1995 (-9, from 16 to 7, as concerns about Taxes and Insurance rose), and the tail end of 1994 (-6, from 14 down to 8, as worries about Taxes and Regulations rose).

What's been said:

Discussions found on the web: