*Once more unto the breach, dear friends, once more.”

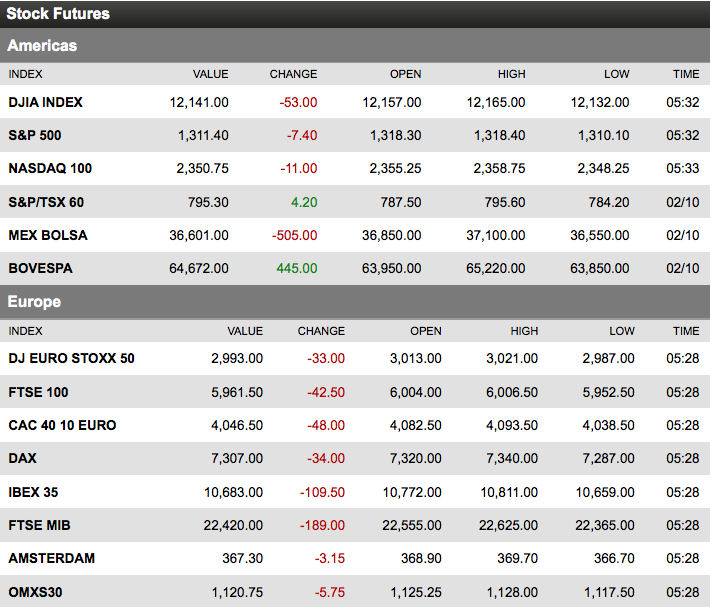

In yesterday’s early AM comments (The Battle of Bull vs Bear), I noted that “opening indications and actual closing prices are two very different animals.” And indeed, despite ugly futures and negative newsflows, markets managed to climb back to flat by the end of the day.

Regardless of what you attribute this to — excess liquidity, improving fundamentals, or as my pal Doug Kass states, sheer madness — it may be helpful to consider how these Futures vs Closes (AM/PM) divergences play out.

It is a war of attrition, and eventually, one side or the other will become exhausted.

The negative AM futures in the US reflect negative bets for a variety of reasons: Arbitraging selling in overseas bourses; bearish bets that selling momentum over there will pressure equity prices over here; general doubts about any global economic expansion. Or simple a bet that the doubling of US equity prices since March 2009 has run is course.

Regardless of the reasons, there are only so many dollars allocated to this trade. If it doesn’t pay off after a certain time period or magnitude of loss, traders move on to something else.

So too, with the opposite side of the bet: There is only so many billions allocated to countering the early morning weakness every single day, and buying that dip. Eventually, that pool of ammo will get exhausted.

I would be lying if I told you I know which side’s cash becomes exhausted first — I have no idea how this ends, but I have my inklings — hence, the 53%c cash position we have as evidence of that. But we are not all cash and we are not short (a small QID slug is our only hedge).

And as we have noted several times (here, here and here) watch the Hang Seng index — it is the canary in the coal mine . . .

>

~~~

*Cry God for Harry, England, and Saint George!’ speech, Shakespeare’s Henry V, Act III, 1598

What's been said:

Discussions found on the web: