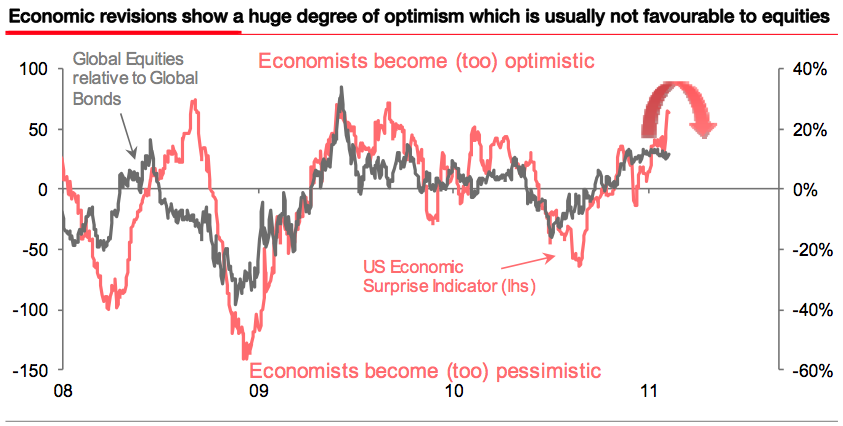

Alain Bokobza of the Société Générale Quant team, writes that their “Economic surprise indicator” suggests risky assets are now technically vulnerable:

“After undergoing a massive rally since last September, risky assets are now technically vulnerable: SG Quant sentiment indicator is close to an all-time high, economic revisions have rarely such a high percentage of upgrades, equity volatility is at a four-year low, the Canadian dollar is dear versus the USD and lastly inflows into equities reached $8bn last month, led by “panic-buying.”

This economic surprise indicator is a measure of the deviation of economic data surprises, calculated as the difference between figures released and figures expected by consensus. Global Equities relative to Global Bonds: 3-month performance of MSCI World Index (in US$, in total return) divided by Barclays Global Bond Index (in US$, in total return).

>

Economic Surprise Indicator

>

Bonds no longer expensive vis à vis equities

1 & 3: time to switch out of bonds into equities

2 & 4: time to switch out of equities into bonds

>

Source:

Don’t despair: correction of risky assets likely coming soon

Alain Bokobza, Roland Kaloyan, Arthur van Slooten, Philippe Ferreira

Multi Asset Snapshot, Société Générale Quant Group

Asset Allocation Strategy

What's been said:

Discussions found on the web: