My Sunday Washington Post column discusses the lack of accountability of the Wall Street execs smashed and grabbed, destroyed their own firms, and crashed the economy. It also describes how to fix this issue: Putting an end to Wall Street’s ‘I’ll be gone, you’ll be gone’ bonuses.

Here’s an excerpt

“How did this happen? Some people blame excessive greed; others say crony capitalism is at fault. I believe we can sum it up in one word: Liability.

In recent years, there was no legal liability for extreme recklessness. Take a healthy company, roll the dice and if it comes up snake eyes, all you lose are your unvested stock options. Most management does not have significant capital at risk.

The cost for pushing a healthy firm into insolvency by excessive risk-taking is some snickering at the golf course. In terms of lost monies, it is minimal.

You might be surprised to learn that it was not always this way. Before these firms went public in the 1970s and 1980s, bank management had full liability for their firm’s losses. During the era of Wall Street partnerships, if employees were so reckless as to lose billions of dollars, the partners were on the hook for the full amount. This meant that after the firm was liquidated to pay its debts, the partners’ personal assets were next on the auction block: Houses, cars, boats, even watches were sold to satisfy the debt.”

Give the full column a once over.

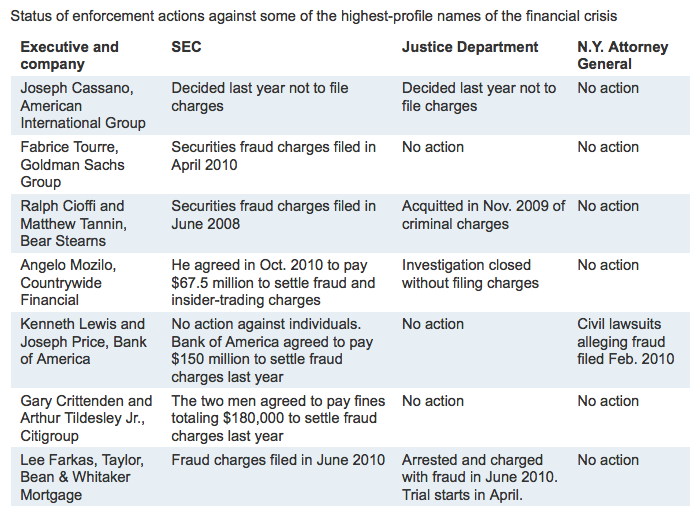

By coincidence, in Saturday’s WSJ, Liz Rappapport had an article titled Lehman Probe Stalls; Chance of No Charges with this very helpful chart:

The need for liability for collapsing your firm in pursuit of bonuses driven by fraudulent profits is increasingly apparent . . .

>

Source:

Putting an end to Wall Street’s ‘I’ll be gone, you’ll be gone’ bonuses

Barry Ritholtz

Washington Post, March 12, 2011; 6:08 PM

http://www.washingtonpost.com/wp-dyn/content/article/2011/03/12/AR2011031204299.html

What's been said:

Discussions found on the web: