The Fed released its G.19 report on Consumer Credit last Thursday, and it stirred some optimism (see also here):

The new U.S. consumer credit numbers reflect an economy that is reaccelerating, and that is very bullish for growth — as well as inflation. All in all, U.S. household credit surged by $7.62 billion in February, ramping up faster than at any other time since June 2008.

I respectfully beg to differ. While the story gives a passing nod to the rise in student loans, the fact of the matter is that student loans are virtually the whole story, and the downward trend/trajectory in credit, save that category, has really not reversed.

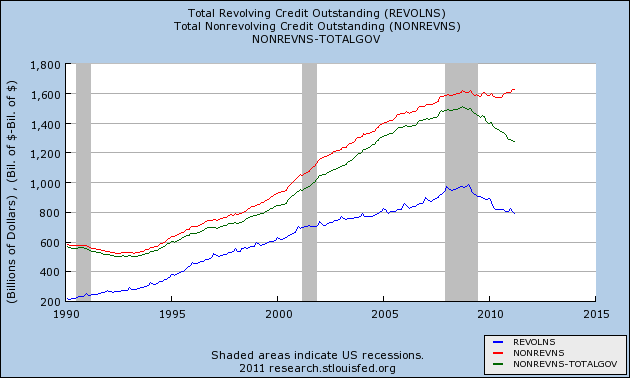

Let’s have a look:

What we’ve got above is Total Revolving, Total Non-revolving, and Total Non-revolving minus TOTALGOV (the category that includes student loans). Without the increase in student loans — which is to say the green line and the blue line — the trend in credit (both revolving and non) continues downward.

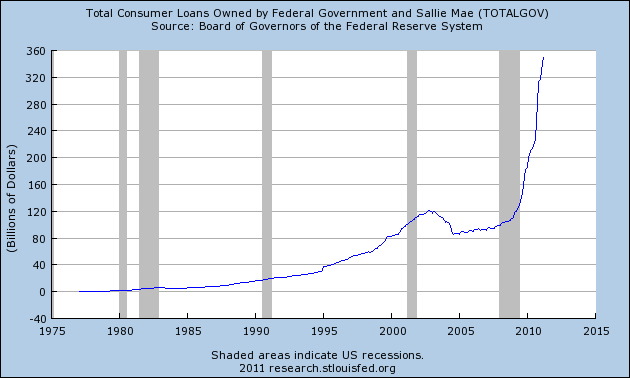

But let’s take a look at exactly how much the TOTALGOV (i.e. Student loan) series is goosing non-revolving credit:

It is, quite literally, a reverse cliff-dive.

In short, fade the notion that consumer credit is experiencing some sort of credit renaissance and that happy days are here again.

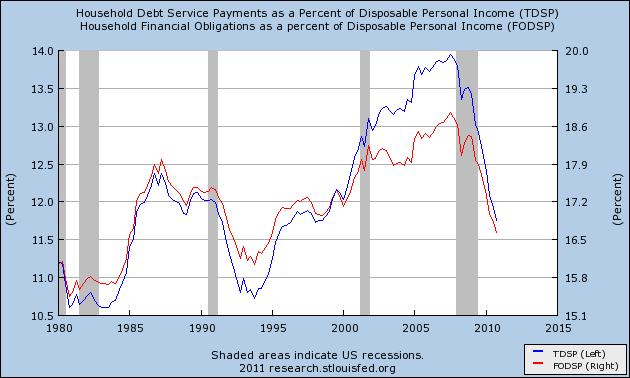

That said, we are indeed moving in the right direction, as these two indicators of leverage clearly show (below). So there would appear to be light at the end of the tunnel. We’ve got a way to go, for sure, but progress is being made. When the consumer credit cycle does eventually turn it is my belief that, for a variety of reasons — such as demographics and the lessons (hopefully) learned by today’s younger adults — it will be fairly weak.

What's been said:

Discussions found on the web: