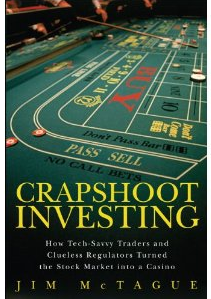

In Crapshoot Investing: How Tech-Savvy Traders and Clueless Regulators Turned the Stock Market into a Casino, James McTague, Barron’s Washington Editor, chronicles the effects of High Frequency Trading (HFT) from the crash of October 1987 to last year’s Flash Crash.

In Crapshoot Investing: How Tech-Savvy Traders and Clueless Regulators Turned the Stock Market into a Casino, James McTague, Barron’s Washington Editor, chronicles the effects of High Frequency Trading (HFT) from the crash of October 1987 to last year’s Flash Crash.

McTague say that equity markets are now “high-speed casinos rigged against individual investors.” In the book, he traces the development of HFT, explains why the Flash Crash happened, and why the odds strongly favor a major re-occurrence again.

Due to high technology of super heated computers, co-location, and heavy algorithmic trading activity, stocks bought and then sold all in a matter of milliseconds, with profits of a tenth of a cent per share traded. HFTs are pulling between ten and twenty billion dollars of profits annually — and it comes straight out of the pockets of mom and pop investors.

I don’t agree with all that Jim discusses — volatility was rising long before 9/11, the dot com bubble cracked in March 2000, the recession ended November 2001 — but for those people who want to learn more about HFT, this is the book for you.

~~~

What's been said:

Discussions found on the web: