From an institutional trading desk:

~~~

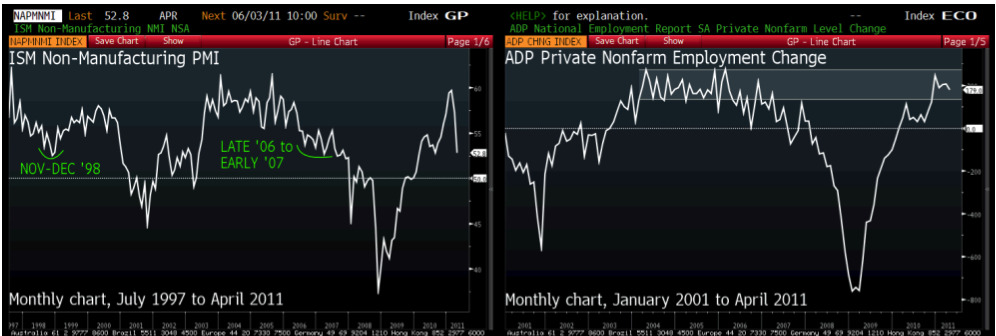

My friend Marshall Auerback wrote me about two weeks ago with a laundry list of observations pointing to a global growth slowdown, and it’s looking like a very prescient email. Both the ADP Employment Report and ISM Non-Manufacturing Index (NMI) came in light today relative to expectations, although on a stand alone basis they were okay. I don’t want to overstate the bearish case: a net gain of 179,000 jobs in April and modest growth in the services sector (52.8 for the ISM NMI headline, above the 50 mark which separates growth from contraction) both constitute economic progress.

The cyclical economic recovery is intact.

However, these reports were significant from a market strategy standpoint because they do call into question the notion that the recovery is self-sustaining. GDP growth driven by private consumption & investment should lead to different market outcomes than GDP growth driven by government consumption & investment (or by export growth assuming a weaker dollar). If we assume that the so-called hand-off between public sector stimulus and private sector growth has not been made, consumer names should diverge with staples outperforming discretionary, and precious metals and energy stocks should benefit from dollar debasement policies. The rest of the winners and losers would be determined by the nature of the stimulus: tax cuts would create different outcomes than, say, a package heavy on infrastructure spending.

Furthermore, given the political polarization we’ve seen over the last several years, the magnitude of any stimulus – again, assuming that today’s reports indicate that the public-private hand-off has not been made – is also uncertain. Hesitation by the fiscal authorities (i.e. Congress resisting the exhortation/influence of Treasury and the Fed) could lead to a debt deflation spiral that would crush equities and commodities and send the bond market soaring, while hesitation by the monetary authorities…aw, shucks, “hesitation by the monetary authorities” – who am I kidding? Under the current Chairman, the Fed will most assuredly address signs of economic weakness with “shock and awe” policies just as it did in August 2010. That’s one of the reasons I rarely have a negative word to say about gold. (Chairman Bernanke’s term is up for renewal in January 2014, by the way.)

Today’s sell-off was probably exacerbated by nervousness surrounding the above issues, but I don’t think the sell-off was generated by them. Maybe in their absence we could have rallied earlier and stronger. There’s something else at work that’s pulling equities lower and reversing the risk trade, and all I can do is speculate about what the cause might be:

1. “Sell in May, go away”? That seems absurdly simple, but then simplicity probably has moved more markets than complexity.

2. Getting out ahead of the end of QE2? Maybe.

3. Questions over China’s growth trajectory? This is probably my favorite explanation. Do you know what the dollar has done against the euro this week? Nothing. It’s flat. Yet, commodities have been waylaid. I know that some of the euro’s strength is attributable to rate hike expectations (watch for “vigilance” tomorrow from JC Trichet), but there is nothing to suggest that the dollar is bid, per se – except for the weakness in commodities (particularly silver, nickel and crude oil, which last I checked are all industrial commodities).

4. Silver has got its own special issues, but the weakness in crude and the other base metals is worth considering. We all know that China drives these prices because we hear about it when the prices go up. Well, not only was China’s latest manufacturing PMI weak (52.9), but in the latest quarterly monetary policy report from the PBoC – released last night – we learned that “stabilizing prices and managing inflation expectations are critical.” It sounds like China is not done tightening.

It’s time, I think, to pay closer attention to the China slowdown story. Evidence of a harder-than-expected landing has the potential to reverse the dynamics of the commodities markets, and it would also shake up the global terms of trade.