Case Shiller is out, and it confirms what we have known for quite some time: Without artificial government stimulus, Housing is going lower.

The double dip in Housing has now been officially recognized:

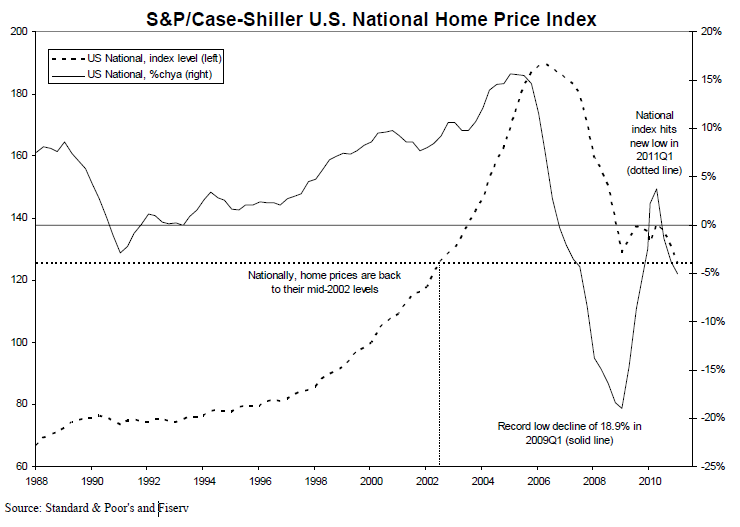

“Data through March 2011, released today Case-Shiller Home Price Indices show that the U.S. National Home Price Index declined by 4.2% in the first quarter of 2011, after having fallen 3.6% in the fourth quarter of 2010. The National Index hit a new recession low with the first quarter’s data and posted an annual decline of 5.1% versus the first quarter of 2010. Nationally, home prices are back to their mid-2002 levels.”

>

>

Previously:

A Closer Look at the Second Leg Down in Housing (June 24th, 2010)

What's been said:

Discussions found on the web: