While Muni Fund Investors Flee, Others Pounce (Bloomberg BusinessWeek)

Fiscal crises in states and cities have prompted big withdrawals from muni-bond funds. Investors with more risk tolerance are being lured by yields near 4 percent

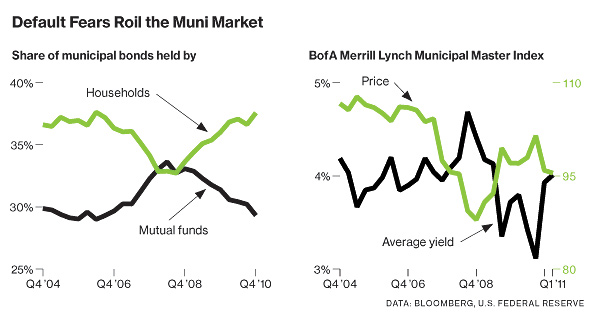

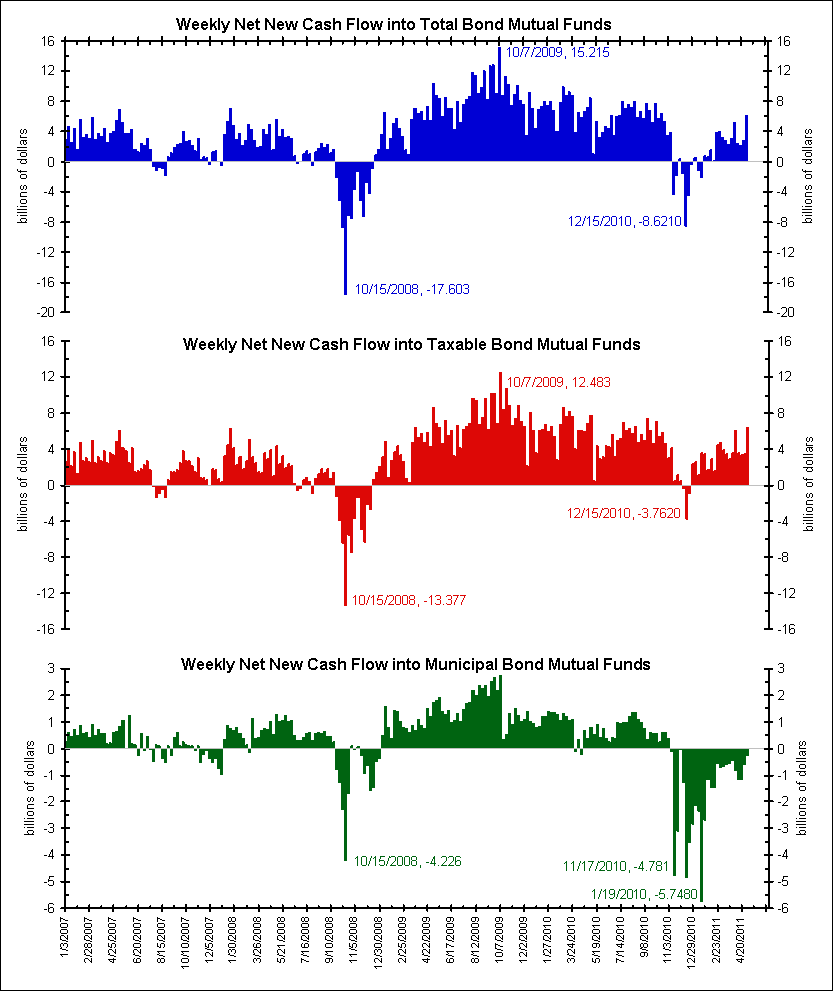

The fiscal crisis in states and cities is a buying opportunity for John Hirsch. He’s been snapping up municipal bonds since the beginning of the year, taking advantage of falling prices as muni mutual funds are forced to sell bonds to cover withdrawals. Hirsch, 57, is looking for income and isn’t worried about fluctuating market values. “I have no interest in trading bonds,” says Hirsch, a consultant to the medical industry in Clermont, Fla. “I’m going to hold until maturity, and at maturity I’ll get the face value back.” Investors have withdrawn about $48.5 billion from U.S. municipal-bond mutual funds since Nov. 10, pulling money for 25 weeks straight, according to Lipper US Fund Flows, a research company in Denver. Those withdrawals have forced mutual fund managers to sell, putting downward pressure on prices. Investment-grade muni-bond prices have dropped 3.7 percent in the six months through May 6, as measured by the Bank of America Merrill Lynch (BAC) Municipal Master Index. That has driven yields on bonds in the index, which rise when prices fall, to 3.74 percent, which is equivalent to a taxable yield of 5.75 percent for an investor in the top 35 percent federal tax bracket. That’s up from 3.46 percent on Nov. 10.

Comment:

See the bottom panel of the chart below. Mutual funds investors started selling muni mutual funds the week of November 17, 2010 and have not had a weekly inflow since. See the middle panel of the chart below. Every week since December 29, 2010 taxable fixed-income mutual funds have seen inflows.

So what happened on or around November 17, 2010 to chase investors out of muni mutual funds? Many like to blame Meridith Whitney’s now famous 60 Minutes interview in which she said, “You could see 50 sizeable defaults. Fifty to 100 sizeable defaults. More. This will amount to hundreds of billions of dollars’ worth of defaults.” The problem is this interview occurred on December 19, over a month after the outflows began. You can’t cause the past.

Back on November 15 we noted that investors started to run away from the muni market when the Build America Bond (BABs) program was not renewed. A lot of issuers of BABs would instead return to the tax exempt market.

click for larger chart

What's been said:

Discussions found on the web: