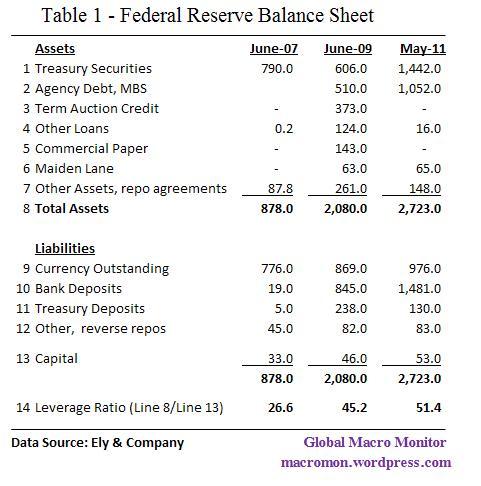

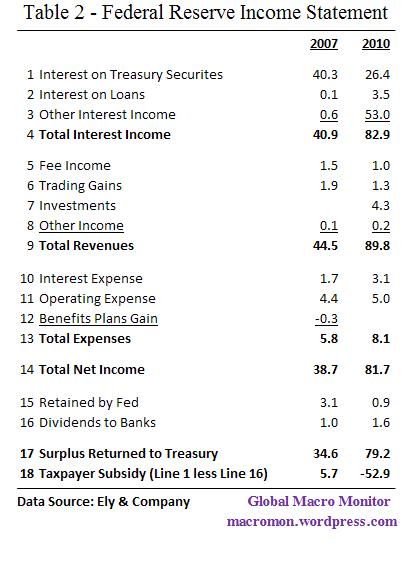

The following data is taken from Congressional testimony of the well respected banking analyst, Bert Ely, illustrates how the Federal Reserve has gone from being a taxpayer subsidized monetary authority to one of the world’s largest and most profitable bank/fixed-income hedge funds. Mr. Ely points out the pre-crisis Fed balance sheet (Table 1) consisted mainly of “Fed-issued currency intermediated into Treasury securities with both of those items compromising 90% of their side of the Fed balance sheet.” On the income side, Table 2 shows that in 2007, which Ely calls the last “normal” year, the U.S. taxpayer provided a $5.7 BN indirect subsidy to the Fed by paying $40.3 BN (line 1) of interest of the Fed’s holdings of Treasury securities, of which a $34.6 BN surplus (line 17) was returned to the Treasury.

Table 1 also illustrates how, since the crisis began, the Fed has more than tripled the size of its balance sheet, increasing its Treasury holdings by $650 BN and purchasing of over $1 TN of MBS and Agency debt. As of May, according to Ely, the Fed held 14 percent of the total debt and MBS issued or guaranteed by the three housing-finance GSEs and Ginnie Mae. The balance sheet growth was financed almost entirely by the creation of bank reserves held as deposits at the Fed (line 10). These reserves now account for almost 10 percent of total banking-industry assets, which, prior to the crisis was effectively a rounding error.

Table 2 shows the Fed’s net income has grown from $38.7 BN in 2007 to $81.7 BN in 2010 (line14). Though the sharp decline in interest rates reduced the Fed’s interest income on Treasuries from $40.3 BN to $26.4 BN, the more than $1 TN purchase of agency debt and MBS helped to generate $53 BN in interest income (line 3) in 2010, up from $.6 BN in 2007. The Fed returned $79.2 BN to the Treasury in 2010 (line 17) and after accounting for the $26.4 BN of interest on Treasuries generated a $52.9 BN profit for taxpayers.

The risks? Take a look the leverage ratio in Table 1 (line 13). John Hussman points out the Fed’s leverage ratio in now higher than that of Bear Sterns and Fannie Mae with similar interest risk though less credit risk. He writes,

The maturity distribution of these [Fed] assets works out to an average duration of about 6 years, which implies that the Fed would lose roughly 6% in value for every 100 basis points higher in long-term interest rates. Given that the Fed only holds 2% in capital against these assets, a 35-basis point increase in long-term yields would effectively wipe out the Fed’s capital…

To avoid the potentially untidy embarrassment of being insolvent on paper, the Fed quietly made an accounting change several weeks ago that will allow any losses to be reported as a new line item – a “negative liability” to the Treasury – rather than being deducted from its capital. Now, technically, a negative liability to the Treasury would mean that the Treasury owes the Fed money, which would be, well, a fraudulent claim, and certainly not a budget item approved by Congress, but we’ve established in recent quarters that nobody cares about misleading balance sheets, Constitutional prerogative, or the rule of law as long as speculators can get a rally going, so I’ll leave it at that.

We’re not sure of the endgame and when and how all this is going to play out. But we do agree with Mr. Hussman that “the predictable outcome is instability.” Toto, I have a feeling we’re not in Kansas anymore.

What's been said:

Discussions found on the web: