Lets catch up with what Matt Trivisonno is seeing over at his Withholding-Tax data crunching site, The Daily Jobs Update:

Federal withholding-tax collections over the last four workweeks came in only slightly above the corresponding period from 2010. Total collections were $126.25 billion versus $125.59 billion – only $659 million more.

>

>

That’s the raw data. But of course, we had a big tax cut back in January. So, taking that into consideration, there is little doubt that we still have a very healthy year-over-year growth rate. And that fits with the fact that we have 1.7 million more private-sector jobs now than we did a year ago.

However, this data does corroborate the last “Employment Situation” report that showed only 83,000 private-sector jobs added to the economy in May, and doesn’t support an upside surprise in the June NFP.

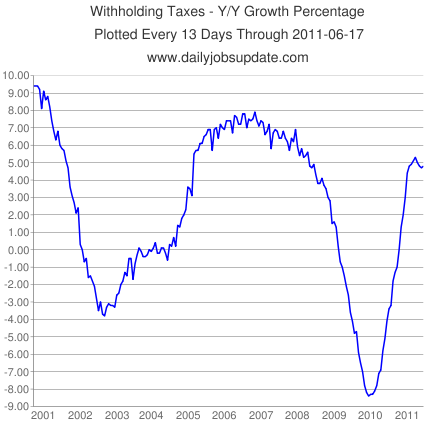

Looking at a longer time-period, we see the second-derivative flattening out, and declining a bit.

>

>

Again, adjusting upward a bit for the tax-cut, this measure is not yet in dire straits. The flattening out is normal as we can see in the last cycle on the third chart:

>

>

The growth-rate went sideways for all of 2006 and 2007 before finally rolling over in 2008.

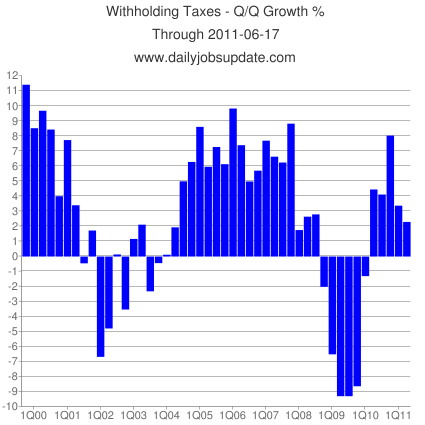

The second quarter is coming in light as seen on the final chart:

>

But again, adjusting the last two bars on the chart upward a bit for the tax-cut shows a respectable performance.

So, while we have solid evidence for a slow-down in hiring, the withholding data is not yet indicating a wave of mass layoffs like we saw in the spring of 2008.

Source:

Daily Jobs Update

by Matt Trivisonno

What's been said:

Discussions found on the web: