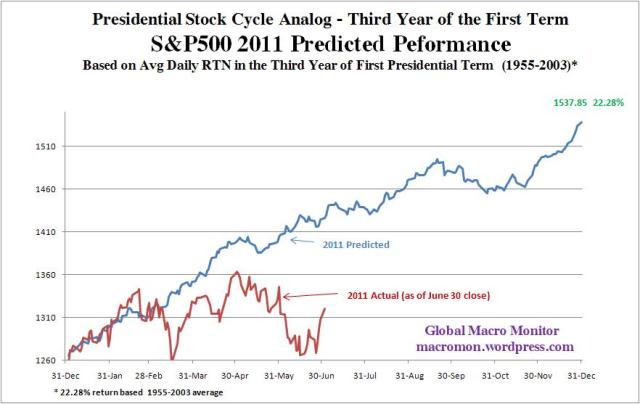

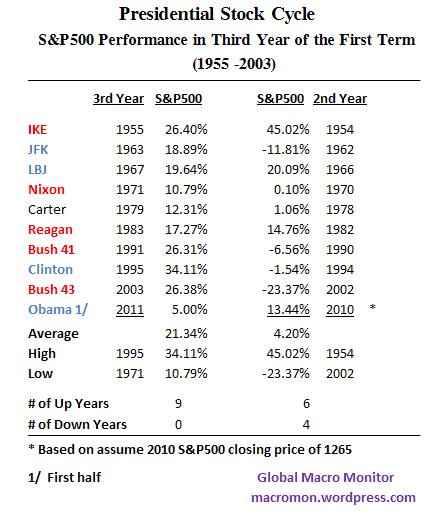

It’s the end of the first half and we’ve updated our Presidential Stock Cycle, Decennial, and 1991 analog charts. Click here, here, and here for background. Note, the predicted performance of the Presidential and Decennial analogs are constructed from the average of daily returns from the relevant years and thus smooths out much of the daily volatility.

So far this year the path of the S&P500 is tracking the Decennial analog fairly closely and has the same character and feel of the 1991 market, also the third year of a first term President and a year that ended in ’1. In addition, let’s not forget that 1991 was similarly a nervous time for investors and full of macro swans, including the first Gulf War and a major credit crunch caused, primarily, by a downturn in housing. Though constrained, we doubt President Obama wants to track the President Bush #41 election analog and will double his efforts to get the economy moving, which may include a new Treasury Secretary.

The last chart illustrates this year’s performance relative to 1991, when the S&P500 ramped in the first few months; though not giving up all of its gains, had a modest correction; and then settled into a relatively tight trading range until the 10.5 percent ramp in the last two weeks of the year. Our best guess is the S&P500 trades in a similar t range – 1250 to 1350 – during the summer and through the end of Q3 then rallies into year end on the traditional seasonal strength. The collapse of the VIX over the past few days may be signalling such a scenario.

The upshot? Patience, don’t chase, and beware of grinding up capital. Stay tuned.

(click here if charts are not observable)

(click here if charts are not observable)

What's been said:

Discussions found on the web: